Happy Tuesday!

NEXT Tuesday, I have a big announcement on the future of Hospitalogy. Stay tuned!

But for now, check out the new Hospitalogy website! What do you think? If you missed it, read my deep dive on private equity in healthcare on the new site linked here!

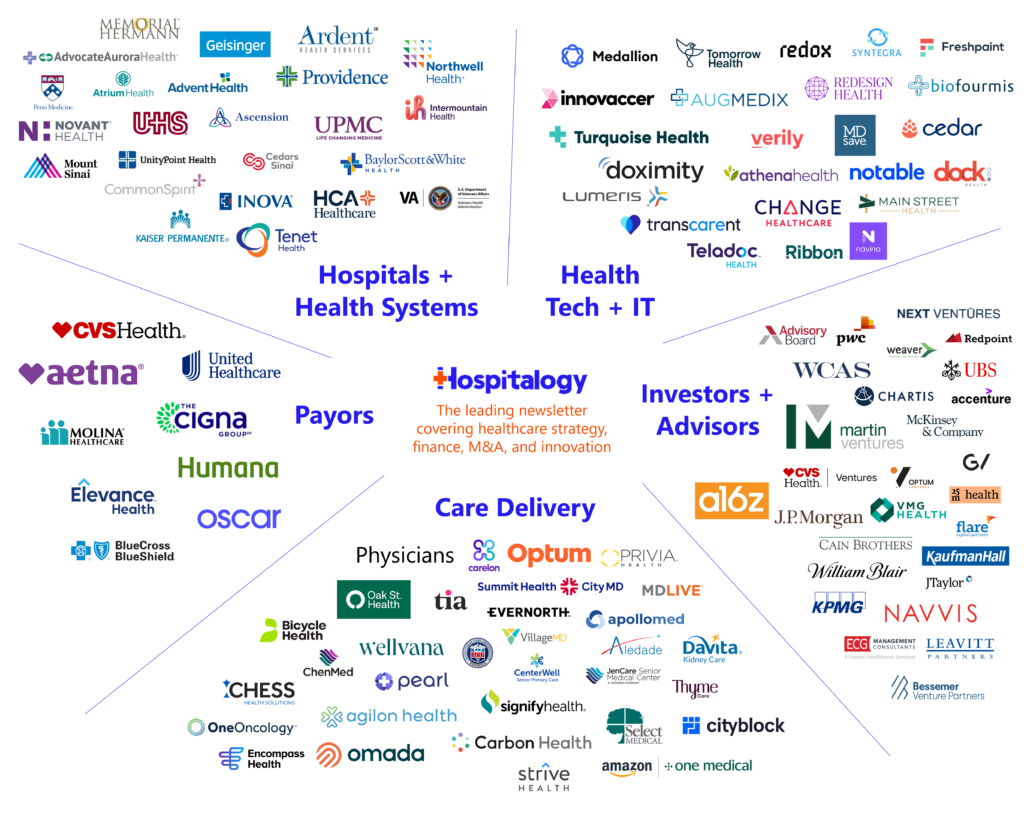

Welcome to Hospitalogy, my newsletter breaking down healthcare strategy, finance, M&A, and innovation twice weekly. Join 28,000+ executives and investors from leading healthcare organizations by subscribing here!

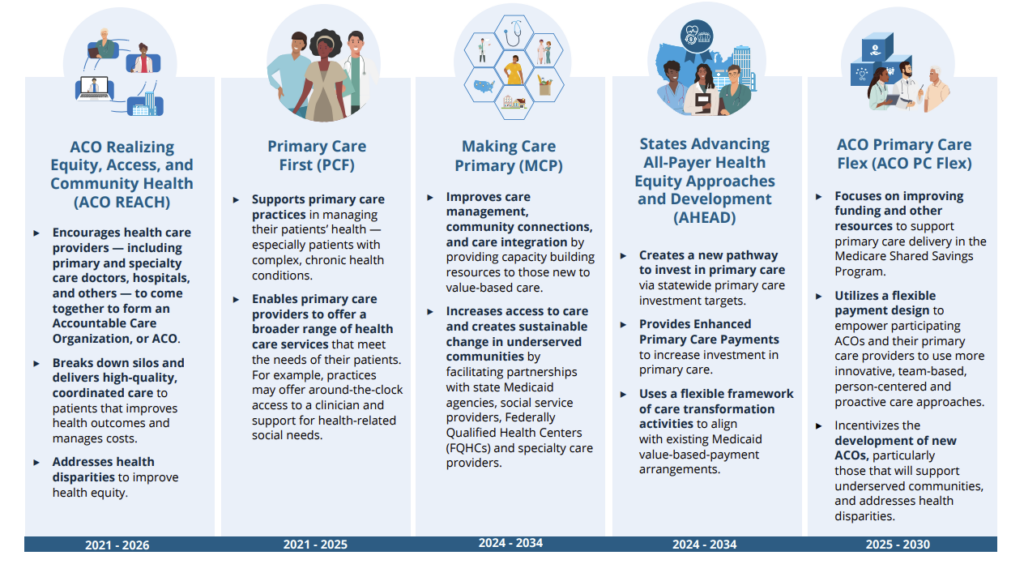

CMS’ Latest Value-Based Care Model: ACO Primary Care Flex

CMS released the ACO Primary Care Flex Model last week with some interesting tweaks.

- TLDR: Starts 1/1/2025. Alternative payment model targeted at low-revenue ACOs, limited to 130 participants jointly participating in MSSP, adds on a one-time upfront advanced payment, and monthly capitated payments for primary care services to incentivize new and existing low-revenue ACOs. Includes FQHCs and RHCs.

- CMS Thesis = MSSP has wide participation. High quality primary care drives shared savings success. Therefor, more investment in primary care and incentivizing participation from groups with characteristics of higher performing (in terms of % savings) low-revenue ACOs should save Medicare more $$$.

Details: The new program a spin-off from the widely successful Medicare Shared Savings Program, but specifically caters to low revenue ACOs (e.g., ACOs typically comprising physician groups or small hospitals). Since low-revenue ACOs have a proven track record of performing better – AKA, generating more savings – in MSSP, CMS wants to double click on these entities and incentivize similarly sized entities to participate in this new model. It’s a bit harder to incentivize low-revenue ACO participation, since they’re inherently at a disadvantage given less access to capital or aversion to taking on risk given unpredictability.

How will ACO PC Flex incentivize participation? By offering upfront payments for primary care services, which helps bolster cash flow to practices who otherwise likely have little cash float to work with (why do you think the Change Healthcare thing was such a big deal?)

- The ACO PC Flex Model will test enhanced and prospective primary care payments to enable more team-based, proactive, and person-centered care by ACOs and their primary care providers. These payments include a one-time Advanced Shared Savings Payment and monthly Prospective Primary Care Payments (PPCP).

- For most model participants, CMS expects that the Prospective Primary Care Payment will increase primary care funding relative to ACOs’ historical expenditures. CMS expects that participation decisions will also be driven by the flexibility afforded by prospective payment and its perceived value for care delivery relative to the status quo and the impact of operational and payment adjustments on the final PPCP rate.

Bigger picture: Through changes with ACO REACH and now this ACO model, CMS and CMMI are collectively making a big push to 1) enable smaller physician group participation and 2) move fast toward that ambitious 2030 risk target we all hear so much about.

Further, in general CMS will continue to push health equity initiatives in these models. It’s a great idea to build on the success of the Shared Savings Program.

Resources & further reading:

- Primary Care Flex Model Homepage

- FAQs

- Factsheet

- Webinar on 4/4/24

- Update On The Medicare Value-Based Care Strategy: Alignment, Growth, Equity | Health Affairs Forefront

- Applications open May 20, 2024 and are due June 17, 2024

Strategy and Policy Updates:

Key considerations for decision makers. Notable moves, policies, and strategies.

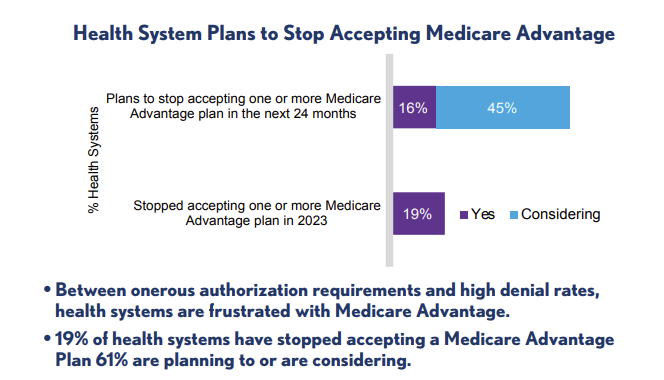

Keep an eye out for the final rate notice for Medicare Advantage coming soon. The general consensus here is that CMS will play ball with insurers a bit and bump up the final rate. Contention is mounting in the MA space between MedPAC’s analysis indicating $88B in overpayments and cynical media coverage (albeit often for good reason). At the same time, up to 45% of surveyed health systems in a recent study are rethinking MA plan contracts with at least one MA carrier. Meanwhile, MA is broadly bipartisan with lots of support, and as recently as last week, a host of lawmakers signed a letter to CMS called for an increase to the final advance rate, exemplifying both the political popularity of MA, and also the power of the health insurance lobby. Also, read this from McKinsey on the future of Medicare Advantage

The U.S. has dropped out of the top 20 happiest countries, according to Gallup’s World Happiness Report 2024

After raising $33M, Modern Health, a startup focused on longevity, is shutting down. Modern Health built a whopping 2 clinics and offered a $500 aging wellness assessment. While I do think there’s a significant play to be made in the longevity space and a massive market, lots of offerings are lathered in snake oil and clearly here the capital allocation strategy didn’t work. Where did that money go? Two clinic buildouts costs what – $1 million? Only 40 FTEs? When I think about what I could do with $33M in the coffer, it’s crazy to imagine others shoveling money down a furnace.

Select Medical Holdings is spinning off its occupational medicine group Concentra to create a separate publicly traded company.

As key Change Healthcare services are coming back online and UnitedHealth Group winds down a $14B+ payment backlog to make provider organizations whole, lawsuits are mounting.

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

“Medicare will cover the costs of Novo Nordisk’s obesity drug Wegovy for some patients with a history of heart disease, a policy shift that could significantly open up access to the in-demand weight loss medicine.”

According to new projections published by the AAMC, the United States will face a physician shortage of up to 86,000 physicians by 2036. Find the link to the full 96 page study in the press release!

HHS gets $117B in funding in the new $1.2T spending package signed this week.

An interesting new law passed in Florida: under the new healthcare law, all hospitals are required to detail how they’ll direct patients to the appropriate care setting (e.g., ED, urgent care, etc.) when a patient comes to the ED, the revolving front door of healthcare.

Kansas and Georgia end their Medicaid expansion plans

Finance and M&A Updates:

Healthcare financial summaries and interesting merger activity

Heritage Provider Network is up for sale again – has been trying to sell itself for a while – and the latest price tag is a rumored $7-8B

Panelists at ACG South Florida’s Healthcare M&A Panel in February discussed preparing companies for a sale, EBITDA addbacks and sector trends. Some interesting takeaways from this article:

- QoE work shifting to the sell side

- Buyers are calling foul on bogus EBITDA normalizations (about time)

- Financial sponsors (PE, etc) are the biggest buyers of healthcare organizations right now, but seem to be moving away from traditional provider deals with one exception being oncology

- Platform deals have been light, but deal activity among larger entities is expected to pick up in the second half of 2024. Personally I’ll be fascinated to see these come through.

Advocate Health divested its senior home care service Senior Helpers to Waud Capital, a well known middle-market private equity firm. Interesting timing on this given all of the hubbub around private equity and senior stuff

VillageMD continues its divestitures streak, exiting the Rhode Island market by selling 11 standalone clinics to Arches Medical Partners. VMD has now exited Florida, Rhode Island, and Illinois altogether totaling 70+ clinic locations

Partnership, Products, and Pilot Announcements:

Collaborations and launches to keep a pulse on.

Regard and Banner Health expand their partnership to bring clinical automation to more hospitals.

Nuance introduces DAX Copilot integrated with MEDITECH Expanse to improve healthcare experiences with clinical documentation automation.

MultiPlan and HealthCorum collaborate to drive high-quality care nationwide.

GE HealthCare and Hartford HealthCare renew and evolve their 7-year collaboration to advance patient care and access in Connecticut.

Ambience integrates with Cerner: ****End-to-end Cerner integrations now available with Ambience Healthcare.

The Medical University of South Carolina and Flatiron Health announce collaboration to drive more standardized, efficient, and effective cancer care.

Remission Medical partners with Sentara Health to expand access to rheumatology care.

Clover Health, Quartet Health team up against serious mental illness.

Panoramic Health and The Kidney and Hypertension Center join forces to elevate kidney care in Ohio.

BJC HealthCare and SSM Health collaborate on a laundry joint venture to bring economic development and jobs to St. Louis.

Ophelia’s virtual OUD care now in-network for Medicaid, dual-eligible Highmark Wholecare members.

Capital Rx, Prime Therapeutics form a strategic alliance – MedCity News.

Anthem Blue Cross and Blue Shield partners with Care2U and Independent Practice Association of New York, Inc. to avoid hospitalizations through an advanced care at home program.

Alo expands outside of the Triangle and Charlotte area for the first time, announcing a primary location in Wilmington, North Carolina

Scene Health and CareFirst expand their partnership for Medicaid members.

Humana and DUOS launch a groundbreaking initiative enhancing care for U.S. veteran seniors.

Innovation Spotlight:

Cool initiatives and reasons for optimism

Nvidia’s AI ambitions in medicine and health care are solidifying as Abridge announces Nvidia’s investment into the firm and other large-scale partnerships form with the likes of Johnson & Johnson and Hippocratic AI which has this weirdly dystopian nurse AI telehealth video

Epic’s bet on generative AI. What do we think – bullish or bearish for all those AI players in healthcare?

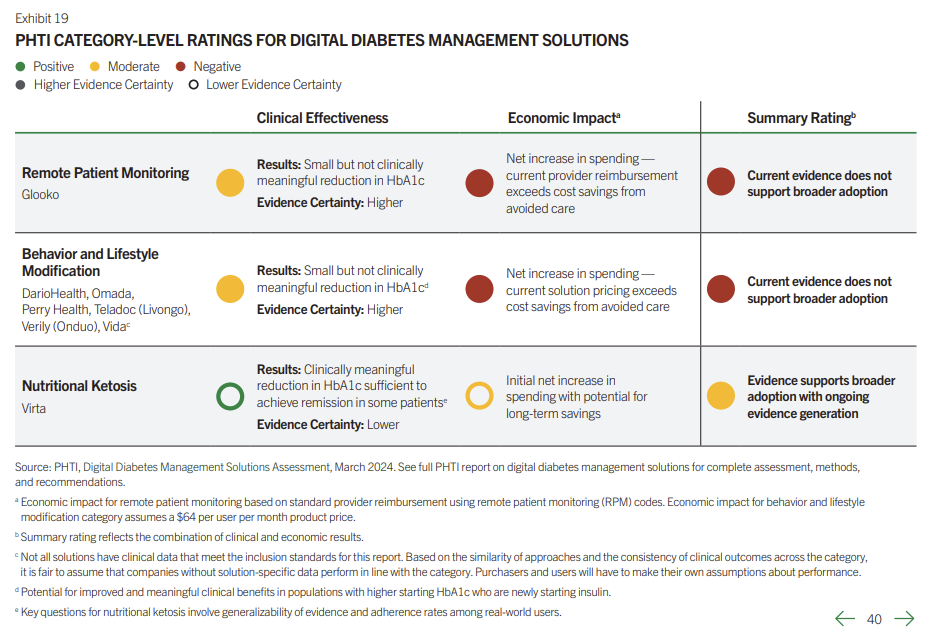

The Peterson Health Technology Institute released its first report on validation of digital health solutions, this time focusing on diabetes management solutions, and found that most provided little to no benefit. Of course, this begs the question – is everyone using or valuing the parameters laid out in the report the same way?

Rock Health released a report on consumer engagement trends

Fundraising Spotlight:

Recent notable funding rounds. AI-generated. The AI really liked the word ‘secure’ this week

- Profluent secures $35M in additional funding to scale foundational AI models for biomedicine and tackle the first vertical in gene editing.

- PocketHealth raises $33M USD in Series B funding to transform medical image exchange and patient experience.

- Pi Health raises over $30M in Series A to revolutionize cancer care and clinical trials.

- Flosonics Medical secures $20 million USD in Series C funding led by New Leaf Venture Partners to accelerate growth.

- Anima brings Salesforce-like capabilities to clinics, raising $12M.

- Assort Health secures $3.5 million to scale the first generative AI for healthcare call centers.

- Conduce Health secures $3 million in seed funding to power a multi-specialty value-based care marketplace.

Hospitalogy Top Reads

My favorite healthcare essays from the week

Join the CareOps virtual event with Oak Street Health to learn more about OSH’s secret CareOps sauce!

Andrew Sprung breaks down marketplace enrollment trends in 2024, main takeaways being concentration at lower-income levels, and a decline in silver plan selections.

Michael Stratton at Health Data Atlas’ nice overview of physician employment and market trends – going a layer deeper by looking at size and employment among MDs and DOs in active practice. HDA tallies that number at 976,580. Michael is a member of my community and Health Data Atlas is doing great stuff for their clients.

Josh Heurung’s analysis of MA star ratings and their components.

Niko McCarty and Elliot Hershberg’s dive on the future of biomanufacturing, including the present bottleneck with the supply of GLP-1s. “GLP-1 drugs could one day outsell iPhones, but there is not enough biomanufacturing capacity to make them. For solutions, we should look away from the factory.”

Dr. Sarah Bauer’s overview of clinically useful data in AI

Does Medicare Advantage Affect the Way Primary Care Practices Deliver Care? Compared to those who mostly saw traditional Medicare patients, PCPs with predominantly MA patients reported higher rates of care coordination, but overall, there were not many statistically significant differences between the two groups.

Growing with creativity and authenticity: Rock Health’s takeaways for healthcare leaders from its 2024 Digital Health CEO Summit.

If you enjoyed this post, subscribe to Hospitalogy, my newsletter breaking down the finance, strategy, innovation, and M&A of healthcare. Join 28,000+ healthcare executives and professionals from leading organizations who read Hospitalogy! (Subscribe Here)