I’m so excited to announce I’ve been named to Pearl Health’s Top 50 Value-Based Care Thinkers of 2024! I am in way too good of company on this list, but it’s so cool to see! Check out the full list here.

Thanks so much to Behavioral Health Tech for sponsoring today’s newsletter. They have created an incredibly cool ecosystem around behavioral health, and their conference is a must-attend for anyone in the space. Highly recommend!

SPONSORED BY BEHAVIORAL HEALTH TECH

Curious about the latest innovations in behavioral health?

Register today for Behavioral Health Tech 2024, the go-to annual conference where over 1,200 leaders from health plans, providers, digital health companies, and benefits consultants converge.

Here’s what one of the attendees from last year had to say:

“Of all of the BH conferences I have been to in the past 13 years, this one, by far, has been the most valuable. I made back my ROI by noon today.”

The event will take place at the stunning Arizona Biltmore from Nov 5th-7th for three days of groundbreaking insights, actionable learnings, and valuable networking opportunities.

By the way, you’ll also want to use promo code HOSPITALOGYBHT24 for $200 off.

Last year’s event sold out quickly, so secure your spot now to avoid missing out on what could be the most valuable conference you attend this year!

1. Blake’s Breakdown: CVS is Bleeding

Going a bit deeper on an interesting topic, theme, or resource

In 2024, CVS is struggling.

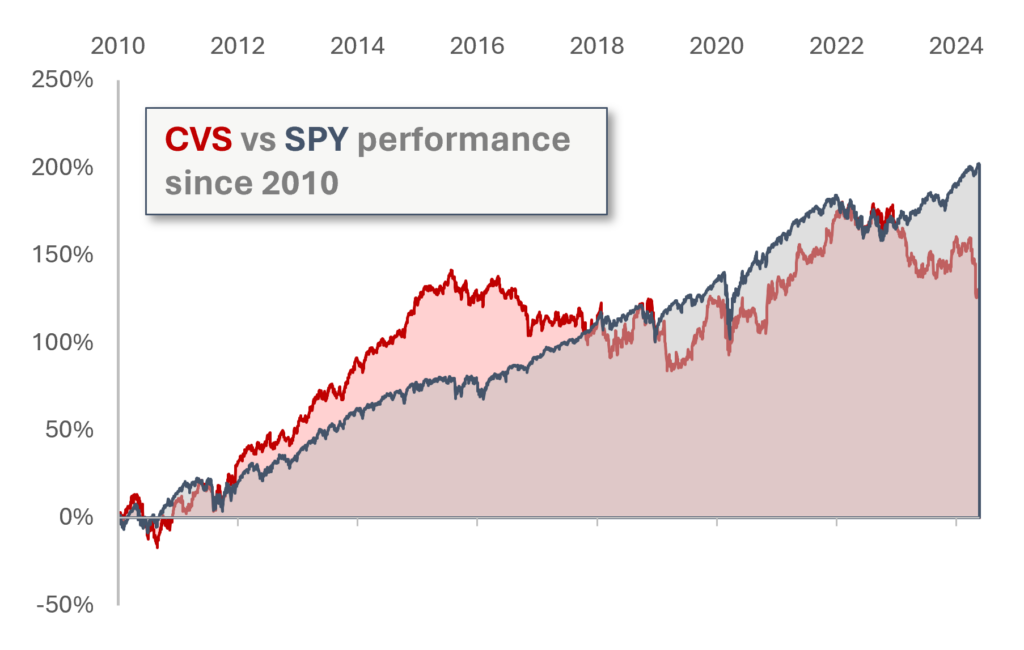

Since 2010, an investment in CVS has underperformed the broader market significantly. It was tracking with the market until early 2023. But note the recent drop-off starting in 2023:

CVS struggles perfectly align with headwinds that began in Medicare Advantage, the decision to acquire Oak Street Health, and generally a rough 2023 including lost Caremark contracts. Finally, we can’t forget about the general macro pressures on its retail pharmacy business.

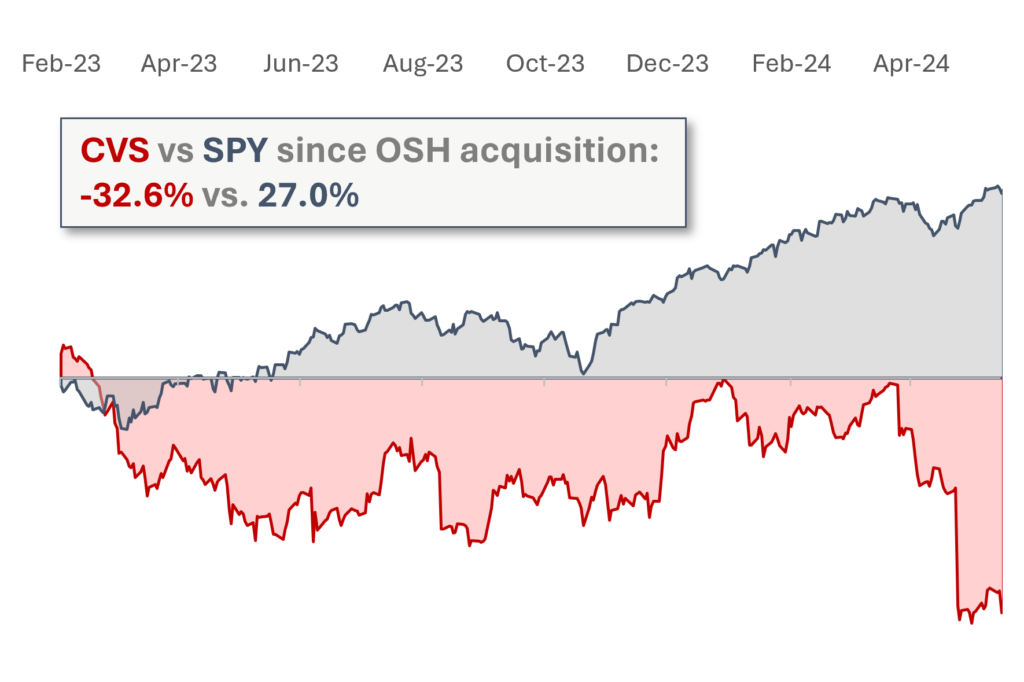

Since CVS’ acquisition of Oak Street Health (a cherrypicked datapoint, no doubt), the managed care behemoth has returned -32.6% while the S&P 500 is up 27% before dividends. Again – passive investing for the win!

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

So what went wrong? A perfect storm of strategic decisions coupled with a market turn for the worse in MA in 2024:

- Capital requirements for Oak Street Health, including the buildout of 50+ centers a year and current patient cohort maturities, are unsustainable given current profitability levels at OSH. Not to mention you need multiple years to reach patient cohort and cash flow maturity (consequently, this dynamic is why you’re seeing CVS beg for a financial capital partner this week akin to Humana-CenterWell);

- Loss of major PBM customers including Tyson Foods and Centene;

- Medicare Advantage headwinds with risk adjustment, unforeseen heightened utilization, star ratings declines, which will lead to a cut in supplemental benefits and a leaned up operation;

- CVS priced low for MA member growth in 2024, exacerbating and compounding all MA-related headwinds above

I put together the below CVS strategy breakdown for Board Room members during 2023, but figured it was worth updating briefly for 2024. Stated simply, CVS is in a state of business transformation and is making plenty of investments in areas where healthcare is headed, particularly in capital-light vehicles.

In 2025 and beyond, you’ll see Aetna member attrition and other pricing actions in order to right-size the Spanish Galleon ship.

Within Health Care Benefits, our Medicare Advantage business is projected to generate between $65 billion and $70 billion in revenues in 2024, but will experience significant losses. We are committed to driving meaningful improvements in our Medicare Advantage margins in 2025. Given our projected baseline performance, 2025 will be the first step in a 3- to 4-year journey to get back to our target margins of 4% to 5%. Improved Star Ratings in 2025 could represent a $700 million tailwind depending on membership retention levels, but also reduces our ability to adjust certain benefits. The remainder of our margin improvement in 2025 will be a function of pricing actions in an environment where we are facing headwinds from an insufficient rate notice and prescription drug coverage changes that substantially increase plan liability. We will take material pricing and benefit design actions for 2025, and the impact of those changes will depend on how cost trends develop in both 2024 and 2025 and how the market responds to those trends. – CVS Q1 2024 earnings call

A Broader Conversation around CVS and Healthcare PR/Comms

CVS also hasn’t done itself any favors in the public eye. It’s commonly referred to as ‘3-letter’ by pharmacists on Reddit.

But the icing on the cake for me was this sponsored op-ed published in April by a CVS Caremark leader on Fortune.

The way this piece comes off to me – which was likely well-manicured by the CVS PR and marketing team – strikes me as pretty tone deaf. “At CVS Caremark, we are creating a more transparent environment for drug pricing in this country.”

Does anyone outside of CVS corporate feel this way? Do CVS clients feel like CVS is being transparent with them? Why is there a revolving door for PBM executive testimony on Capitol Hill? Why is CVS losing major PBM customers?

Sorry. Probably too many rhetorical questions. I digress!

I’m hard-pressed to believe anyone thinks CVS is a transparent, forthcoming company, given the level of discourse around PBMs and the evergreen lack of transparency these business models present in healthcare – especially as the water muddy further with vertical integration.

Maybe I’m wrong. Maybe CVS really is leading the way in transparency. CVS, if you are, you’re more than welcome to buy an op-ed in Hospitalogy to tell me how wrong I am!

Along with the language around transparency, where PBMs historically have had no room to talk, CVS is so unbothered by Cost Plus Drugs that they devoted ~20% of the paid media piece to talking about…Mark Cuban’s Cost Plus Drugs. It’s not lost on me that CVS responded to Mark Cuban’s ‘side hobby’ by launching an entirely new pricing model called Cost Vantage that …happens to be essentially identical to the Cost Plus Drugs pricing model.

Long term, as the diversified behemoth it is, CVS will continue to survive. Ironically, CVS has performed so badly, and it’s so big and well diversified that…this may actually be the best time to buy stock in CVS. That’s NOT financial advice. But if you buy the business transformation CVS is presenting, and the long-term play at its disposal over time in Medicare Advantage and vertical integration of healthcare delivery assets, then there’s no better time to get in. Even with more opacity than ever in healthcare.

Further reading:

- CVS: changing the narrative in 2024

- Analyzing OSH’s growth trajectory from private, to public, to vertically integrated with CVS

- It’s time for facts in the PBM debate

2. What’s Trending:

Social discourse and conversations from around healthcare

Superpower’s launch announcement generated a ton of buzz on social media. The company is looking to build a parallel health system focused on longevity and prevention. The launch in and of itself is a masterclass in how to build hype around a new company, as several large investors and folks with large followings commented their support. Here’s the full thread, and here is superpower’s manifesto.

3. Community Update

The latest from inside my community of healthcare thinkers

The Board Room Community HUB has launched! It’s basically a customized social media platform – meaning a one-stop shop for all things community – networking, content library, upcoming events, and more.

Dollars and Deals

Finance and M&A updates

- Akili reports first quarter 2024 financial results and provides a business update.

- Jefferson Health and Lehigh Valley Health Network sign a definitive agreement for a $14B merger.

- Doximity announces fourth quarter and fiscal year 2024 financial results.

- PACS Group announces the pending acquisition of operations at 53 facilities in the Pacific Northwest.

- Sound Physicians announces a transformative transaction to increase liquidity and financial flexibility.

- Providence CFO eyes a strong 2024 after a $176M operating gain in Q1.

Venture Spotlight

Notable Startups and Fundings

- Lycia Therapeutics lands $106M for protein degraders that treat autoimmune & inflammatory diseases.

- Tuesday Health launches supportive care solution with $60M of strategic investment from healthcare leaders.

- Rad AI clinches $50M to scale generative AI tech for radiologists.

- Chapter raises $50 Million led by XYZ Venture Capital to help seniors maximize their Medicare.

- SmarterDx raises $50M to bolster hospital revenue integrity and quality with its clinical AI solution.

- Nabla Bio secures $26M Series A financing for generative protein design, with collaborations with AstraZeneca, Bristol Myers Squibb, and Takeda.

- May Health raises $25M in Series B funding to advance ovarian rebalancing therapy for PCOS.

- Sift Healthcare raises $20M Series B funding round to enhance AI-powered payment solutions.

- Watershed Health secures $13.6M in funding to fuel adoption by large health plans and meet provider demand for real-time patient care coordination.

- Truveris secures $15 Million in Series E funding through Canaan Partners and New Leaf Venture Partners.

- Hamilton Health Box raises $10 Million in Series A funding to accelerate rural market expansion.

SPONSORED BY BEHAVIORAL HEALTH TECH

Have you gotten your ticket to Behavioral Health Tech 2024 yet?

This is basically the ‘Super Bowl’ of behavioral health for anyone interested in the latest innovations that benefit employers, health systems, insurers, investors, policy-makers, and patients alike.

Join over 1,200 leaders at the Arizona Biltmore from Nov 5th-7th, and use promo code HOSPITALOGYBHT24 to save $200 on your registration.

Don’t miss out—last year’s event sold out fast!

You can secure your spot below.

Startup Spotlight

Welcome to the first Hospitalogy Startup Spotlight! Thanks to those of you who have submitted your startup so far. As these trickle in, I want to present health tech startups in a transparent way, so we can better understand the ecosystem and what your startup does. Today’s startup spotlight is GalenusRx

What problem are you trying to solve?

Two things:

- The over $750 Billion dollar problem of unoptimized medication regimens, on the spend over $600 B on drugs in the US, resulting in preventable adverse drug events (ADEs), excessive and preventable morbidity and mortality. The problem is the lack of technology to evaluate complex medication regimens, with actional insights.

- The problem of pharmaceutical companies excluding the types of patients who will actually be taking their medications from clinical trials (i.e., women, elderly, minority populations) through the inclusion of these populations in clinical trials, virtually to assess medication safety parameters.

As simply as possible, what does your startup do?

- GalenusRx is the world’s most advanced medication safety organization. Uniquely, our platform analyzes drug-drug, multi-drug, drug-gene, and drug-disease interactions to provide comprehensive risk assessments, individualized down to the DNA. While a traditional clinical decision support tools and PGx test offers data, APPRAISE(tm) (Actionable PolyPharmacy Risk Assessment Index for Safety and Equity) produces actionable insights with potential benefits that reach across every level of healthcare. Global pharmaceutical organizations can use GalenusRx insights to power safer, more accurate biosimulations, trimming timelines and enhancing ROI. Value-Based Care such as Accountable Care Organizations, health plans, employers, etc… can identify individuals at high-risk for adverse drug events in large populations. Individual clinicians can access APPRAISE to provide more effective treatment to patients at a lower cost. And the platform’s capabilities continue to advance, driven by the vision of our leadership and grounded in evidence from peer-reviewed literature published by our founders.

How do you make money? How much revenue are you generating?

- We charge a PMPM for our services and guarantee a 10% reduction in hospitalization rates from baseline compared to a control group. For Pharmaceutical companies, we offer one time charge for virtual clinical trials along with clinical services programs for the appropriate prescribing of their medications in patients who are taking multi-drug regimens.

What differentiates you?

- The capabilities of GalenusRx’s medication safety assessment platform, APPRAISE, stretch well beyond traditional Medication Therapy Management. By analyzing drug-drug, multi-drug, drug-gene, and drug-disease interactions, we provide a far more comprehensive risk assessment for patients, addressing the probability of adverse drug events and assessing whether specific drug-metabolizing genes are present. And unlike traditional platforms, APPRAISE provides a precise profile for each and every patient, individualized down to the DNA. Using a proprietary process, our Precision Clinical Pharmacists also provide actionable insights and recommendations for each patient’s drug regimen, tailored to their needs and goals. GalenusRx founders have demonstrated an ROI of 3:1 or greater with value-based care clients.

If you’ve raised money, what was your latest funding round $ and valuation, if available?

- We raised over $5 Million from our first angel round

Any recent company news, resources, or research to learn more about the space your startup operates in?

The changing landscape of value -based care, including that by 2030 all of Medicare will be at risk for outcomes, aligns with our goals of supporting hospital and provider organizations to identify and reduce adverse drug event risk using our APPRAISE solution.

Some background:

- In a 1995 published article, authors highlighted that $76.6 B were spent on drugs and for every dollar spent on drugs, we spent another $1.25 cleaning up the problem of drugs.

- This was updated in 2000 to $177.4 B spent on drugs with the same impact on the cost of unoptimized medication regimens, higher than the cost of drugs.

- Finally, the third research study published in 2016 estimated annual cost of prescription drug was $520 B and the cost of drug–related morbidity and mortality resulting from nonoptimized medication therapy was $528.4 billion, with a plausible range of $495.3 billion to $672.7 billion

Recent company news:

- Our partnership with Hannover Re to help reduce their stop-loss risk, demonstrates the interest in adverse drug event risk prevention by healthcare reinsurers .

- Also, our partnership with HealthOme where we will interpret pharmacogenomic test and add these results to the APPRAISE solution to identify level of concern for ADEs, and providing consultation to individuals, in collaboration with their providers to reduce any potential concern.

Hiring roles:

We are hiring a Lead Business Development Manager for Pharma Biosimulation/Virtual Clinical Trials–email: [email protected]

Submit your Startup: Each week, I want to start highlighting a cool startup doing innovative things in healthcare – with the caveat that I’m asking you to be a bit more transparent. All answers submitted confidentially to me. Submit your startup here.

Thanks for reading! Subscribe to Hospitalogy, my newsletter breaking down healthcare finance, M&A, and strategy twice weekly. Join 32,000+ executives and investors from leading healthcare organizations by subscribing here!