This week continues our series on major themes from hospital earnings – management commentary, key trends to take note of, financial trends, and operating performance.

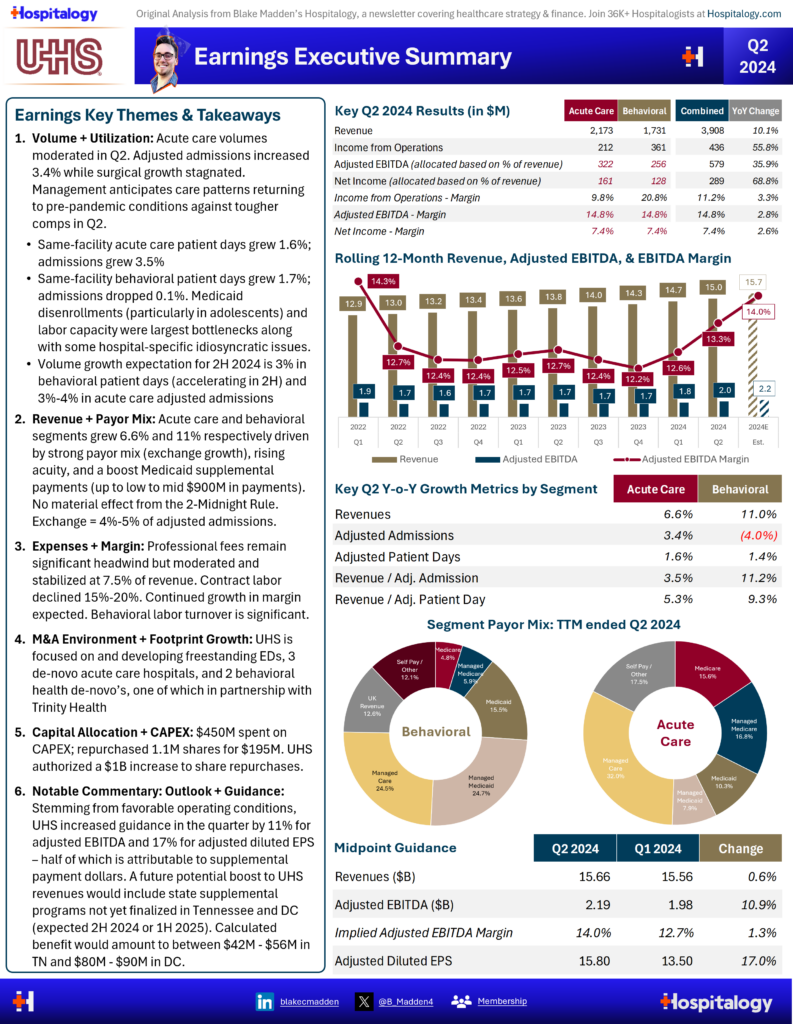

Today we’re diving into UHS along with some notable nonprofit reports to illustrate the gap between well-performing systems and those struggling to make it in 2024.

Key theme continuation for Hospitals in Q2

Takeaways for hospitals from Q2 – and today – among outperforming health systems include:

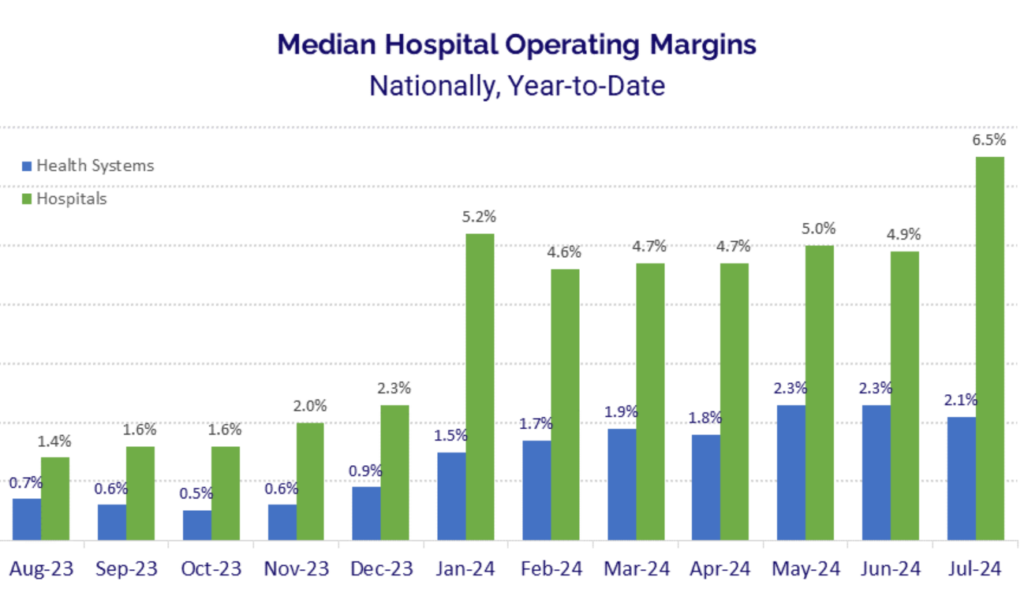

- Strong expense management leading to the strongest margins we’ve seen post-Covid. From Strata’s July benchmarking report:

- Favorable payor mix trends continue as patients move from Medicaid (worst payor) to Exchange plans (2nd best payor)

- Rising acuity levels continue. This affect, compounded by a shift to commercial payors, led to strong revenue per unit of volume growth

- Elevated utilization and demand for healthcare services

- Normalized labor environment and trough in contract labor environment

- Tailwinds from state supplemental payment programs

Despite a much better operating environment in 2024 than any year since the pandemic, this outperformance isn’t the case for everyone. Take for example, Legacy Health and Nuvance Health. Both of these systems are merging out of survival (with OHSU and Northwell Health). They’re struggling financially with margins well in the red – Nuvance at -4.9% and Legacy at -5.9%. By the way – the Northwell-Nuvance merger was approved today. You can read my analysis of the deal here.

These systems are still affected by, but not limited to, the following headwinds:

- Poor demographics in local markets (population growth) leading to little or no growth prospects

- Tougher labor environments

- Inability to negotiate price with payors; and

- Inability to invest capital back into their enterprises

UHS Q2: Acute Care Volumes Moderate, but Guidance Boosted by Supplemental Payments

Nonprofit health system Q2 reports: Rapid Fire

I will likely take a deeper dive into nonprofit financials and operations at some point, but for now here are some highlights for the below health systems during the 1st half (6 months) of their respective fiscal years:

Kaiser posted revenues of $56.5B during the first half of 2024, up 12% from revenues of $50.4B in 1H 2023. Operating income doubled to $1.84B (3.2% margin).

Providence noted improved operating performance stemming from higher utilization, lower contract labor usage, and lower length of stay. Operating revenue grew 6% to $15.5B and EBITDA grew substantially to $808B (5.2% margin)

Intermountain revenues grew 7% to $8.5B while EBITDA margin expanded to 7.6% of revenue on growth of 18.8%, signaling major expense leverage for the Utah-based integrated health system.

Advocate’s enterprise wide performance saw marked improvement. Operating income jumped to $450M (2.7% margin) on 9.8% enterprise wide revenue growth, totaling $16.7B.