Join my Hospitalogy Membership! If you’re a VP or Director working in strategy or corporate development at a hospital, health system or provider organization, you will get a lot of value out of my community as I purpose-build the content, fireside chats, and conversations for this group. Join for free today.

Privia Health Q4 2024 Earnings Call: Key Takeaways & Outlook for 2025

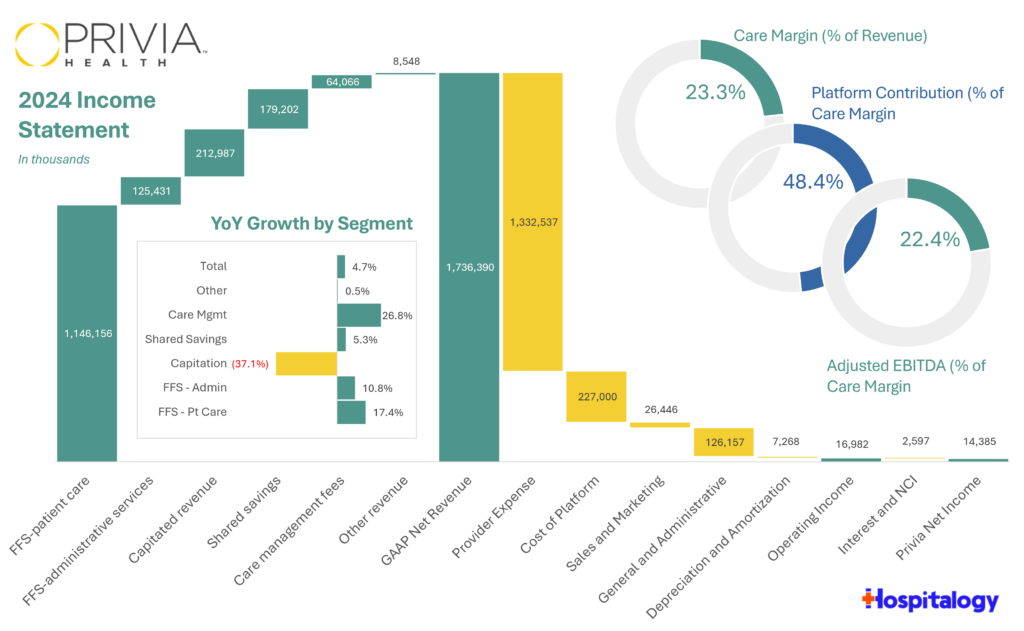

How does Privia Health make money?

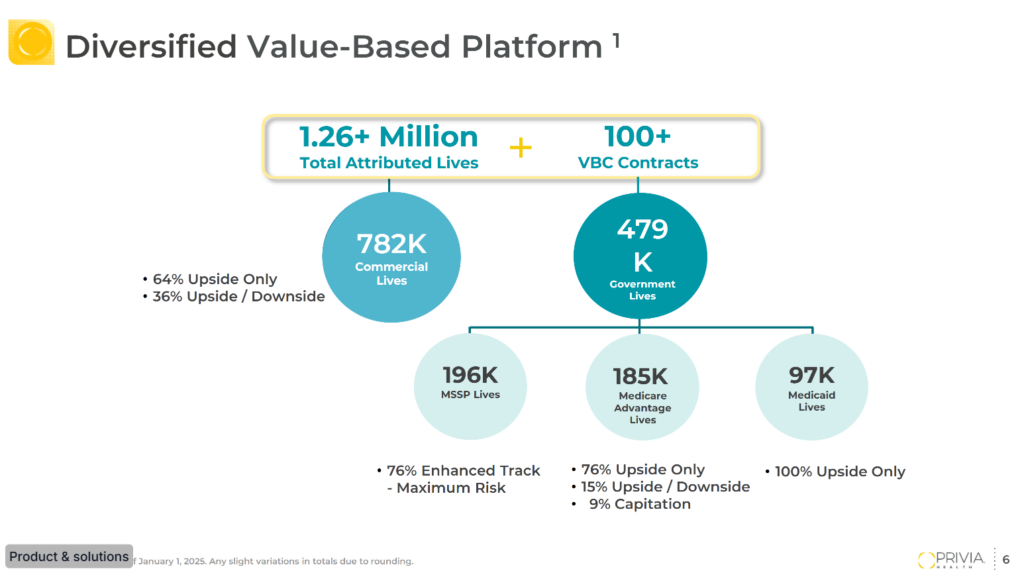

Privia’s model is pretty interesting. It works across all payors and all payment models (fee for service, MSSP, capitation). In 2024 you can see Privia shied away from full risk (capitation) given MA headwinds and unfavorable environment.

Privia management echoed as much on their 4th quarter earnings call: Privia is after delivering the most value to its primary stakeholders: physicians (and by extension, patients) – and Privia wants to maximize its ability to provide value to those physicians, similar to most other firms in the enablement/MSO space.

So, Privia can benefit both from (1) a high utilization environment through FFS revenue and (2) markets or conditions where it’s appropriate to take risk and expand that book of business.

“We continue to expect headwinds in Medicare Advantage over the next few years, given pressures from elevated utilization trends, phase-in of V28 through 2026 and changes in star scores among other factors. However, the diversification of previous value-based care contracts gives us confidence in our ability to build scale and profitability across the business despite challenges in any one particular program…Ultimately, our goal is consistent and sustainable earnings growth for all medical groups and shareholders year after year.” – Parth Mehrotra

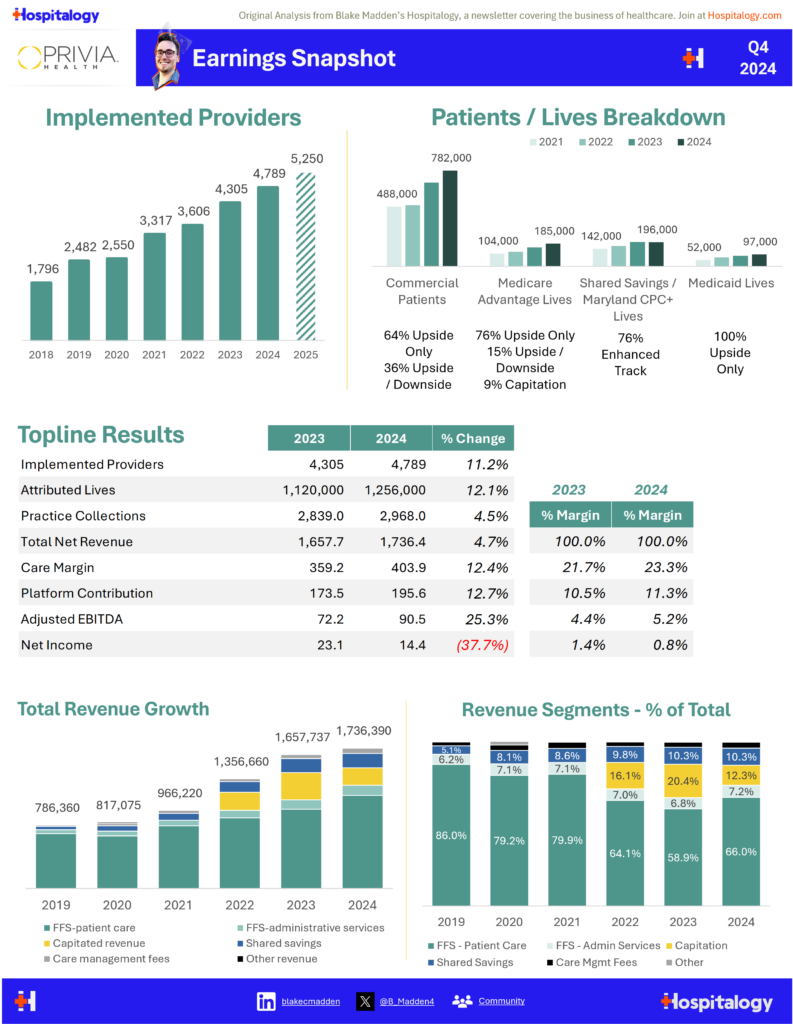

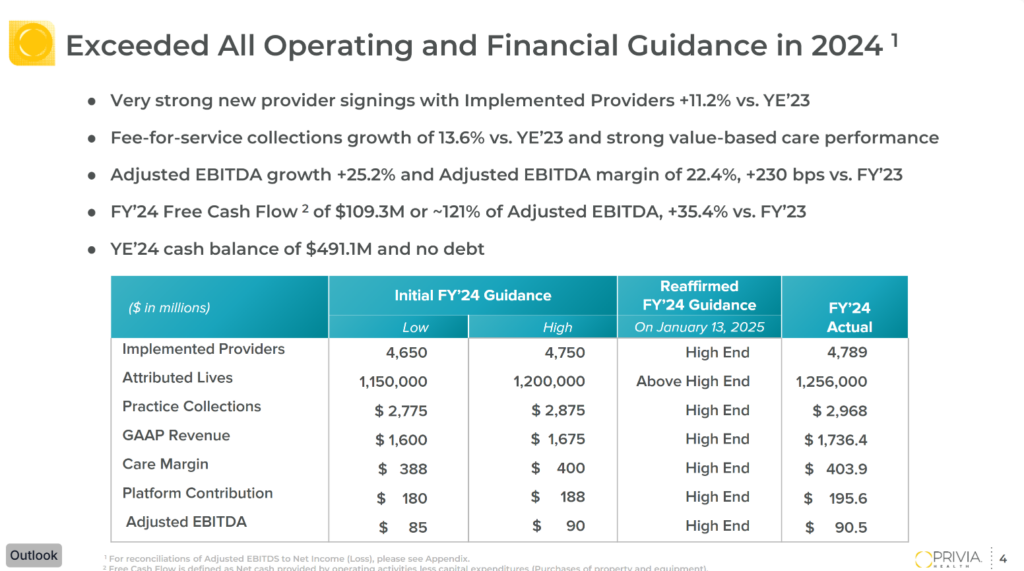

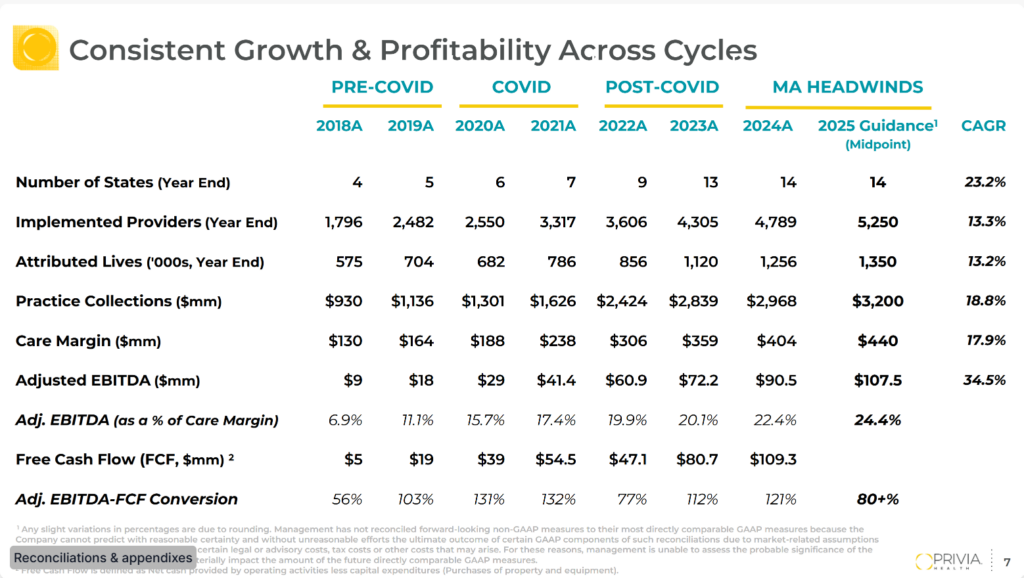

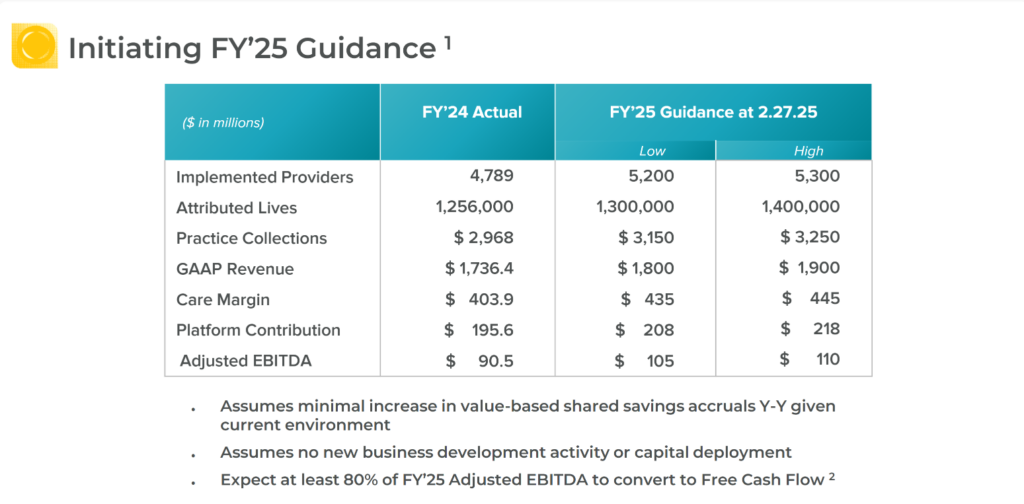

In 2024, Privia Health closed out the year on a strong note, exceeding the high end of all guidance metrics and setting the stage for continued growth in 2025. Privia signed above the high end of its implemented providers (a key economic signal for Privia’s overall business) range – 4,789 in total.

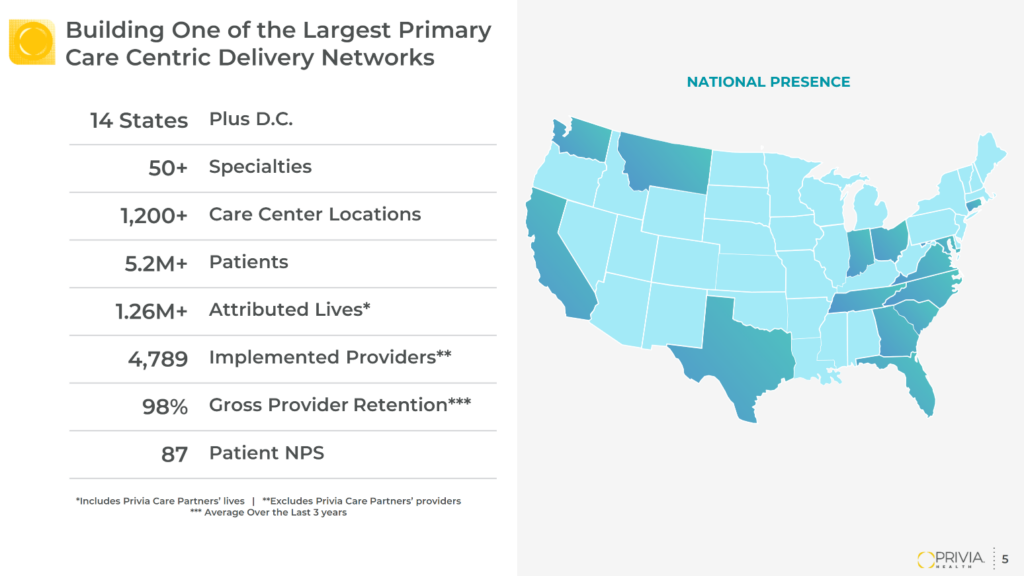

Privia’s current footprint includes 14 states and 1,200 care locations:

2. Revenue Growth and Payer Mix: Diversification Mitigates Medicare Advantage Pressures

Capitated revenue book showed a 2% positive contribution margin, though the Privia team still wants to be pretty conservative around committing fully to downside risk as mentioned. Value-based care diversification across commercial and government contracts provided resilience against sector-wide headwinds. Privia also noted it’s not expecting any sort of bump in growth from its shared savings book of business in 2025 based on ongoing pressures in MA.

This quote on propensity for Privia to take risk is one Parth Mehrotra reiterates often, and it’s a great way to look at value-based care as a whole and every stakeholder having ‘skin in the game’ – over and over, Privia mentions their preference for shared risk being the right approach to value-based care:

- “…you have to distinguish between the willingness to take risk and the ability to take risk. We’ve always had the ability to take risk. We do so at the highest level in MSSP as you know. We do capitation in MA with a small book. I don’t think providers wake up every day saying we want to do full risk. I think there’s a lot of noise in the space by entities that jumped into full risk. And I think it’s a misconception that to perform well in value-based care, to perform well in MA, you necessarily need to take full risk. We’ve always said we prefer models where the payer has skin in the game, an entity like Privia that’s enabling has skin in the game and the doctors have skin in the game or the medical groups and the risk entities have skin in the game. And we share it upside and down, and I think that keeps everybody honest.”

5. 2025 Outlook and Guidance: Hitting the Singles and Doubles, Compounding the Biz

Privia continues down the path of solid year over year growth in a capital efficient model. Management expects to reach 5,200+ providers in 2025, around a 10% increase during the year.

In 2025, Privia will continue to hit on core execution, which is pure and simple as the following:

- “…first, provider growth to increase density and scale in existing and new markets; second, attribution growth and performance in value-based arrangements; and third, operational improvements and efficiencies that impact the bottom line.” – David Mountcastle

Privia’s operating model in mature markets is also proving out, as the firm expects margin expansion and significant (19%) adjusted EBITDA growth stemming from operating leverage in its most mature markets. It’s also significant from the perspective that Privia seems to be focusing on building out existing density in current markets, and seemingly no short term plans to enter new markets according to commentary around what’s included in its guidance.

I should note Privia has a decent amount of cash on the balance sheet and I wouldn’t be surprised to see it put to use. Management was coy around M&A but we already saw another big deal happen between CVS and Wellvana this week (more on this in the near future) so blood is in the water.

- “We’ve said previously, we’re looking at medical groups, risk entities, MSO entities. Given our model, I think we can be very flexible.”

Another interesting point from the analyst Q&A centered around ACO REACH, whether the program receives an extension, and how that might affect Privia’s ability to recruit more provider groups if there’s any fallout there. Privia noted it prefers to say in MSSP, thinks it’s a better model, and that any potential convergence happening between the two would validate that position.

Final Thoughts: A Resilient Growth Story

Privia Health demonstrated another year of strong execution, marked by provider growth, financial discipline, and strategic diversification. While Medicare Advantage remains a challenge across the industry, Privia’s balanced mix of commercial and government contracts provides a uniquely flexible model in the market, which is why Privia has been relatively successful compared to its other VBC peers post-IPO. They’re also going to continue to shy away from capitation and will be careful with taking on full risk. I’ve said it before and I’ll say it again: Privia is disciplined with its approach to growth and is focused on compounding the business by hitting singles and doubles.

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.