I don’t think our healthcare system wants us to sleep this week! Today we’re diving back into CVS and Oak Street Health, and we’ll also be looking at how things are rapidly evolving in the Great Payor Vertical Integration Wars.

Join 20,000+ executives and investors from leading healthcare organizations including HCA, CVS, and Tenet, nonprofit health systems including Providence, CommonSpirit, and Atrium, as well as leading digital health firms like Tia, Carbon Health, and Oak Street Health by subscribing here!

Post Outline

- Key Takeaways & my take on CVS-Oak Street Health

- Deal Terms and announcement

- The Oak Street Health business model

- CVS Health Strategy Breakdown

- Vertical Integration is the Key

- Implications on other value-based players and venture

- Parting thoughts and reactions

- Resources, acronyms and terms to know, and footnotes

CVS-Oak Street Health: Key Takeaways

Payvidors and other strategic players are investing significant capital into primary care.

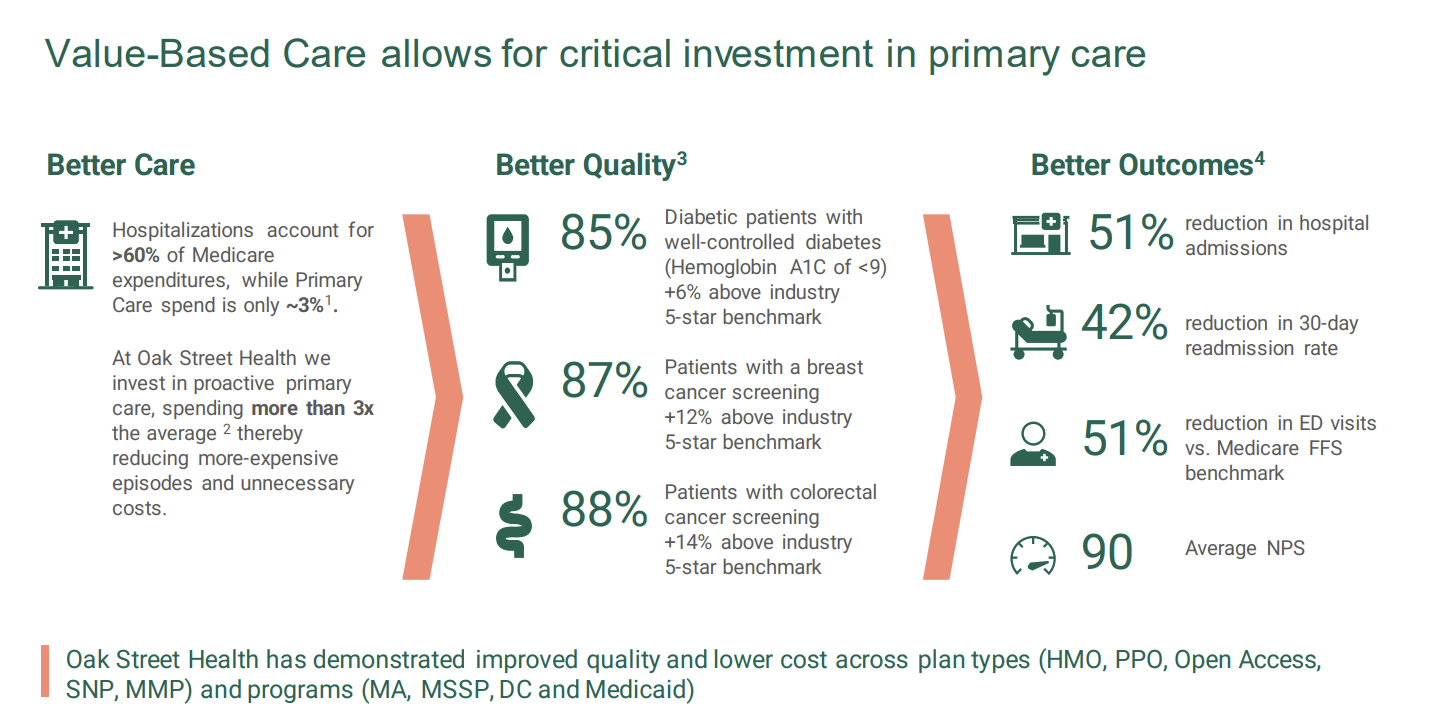

Oak Street Health’s main business goals are to lower total cost of care by preventing unnecessary acute events and managing chronic disease, all while providing a better patient experience. As a primary care operator working in with Medicare beneficiaries, Oak Street Health has done an incredible job of pushing the value-based care agenda forward.

From an operating and clinical perspective, acquiring Oak Street Health will afford CVS greater integration in its care delivery model, which will result in better care coordination for patients, more patient satisfaction, increased access for Medicare Advantage (”MA”) members and dual-eligibles, boosts in quality, and reductions in total cost of care.

From a financial and strategy perspective, acquiring Oak Street Health should boost CVS/Aetna’s MA star ratings, enhance member recruitment and retention, enable better risk coding, and unlock a national primary care platform for long-term profitability and future growth.

As MA enrollment swells, payors are focused on building out national footprints to attract and retain patients while focusing on managing overall medical spend for an aging population dealing with chronic conditions. Oak Street Health fills many pressing needs for CVS.

Medicare Advantage is a key area of growth for most payors. Market share is up for grabs as the population ages into the entitlement program in a competitive environment. Meanwhile, Medicare Advantage penetration is a rising tide as it overtakes traditional Medicare in 2023.

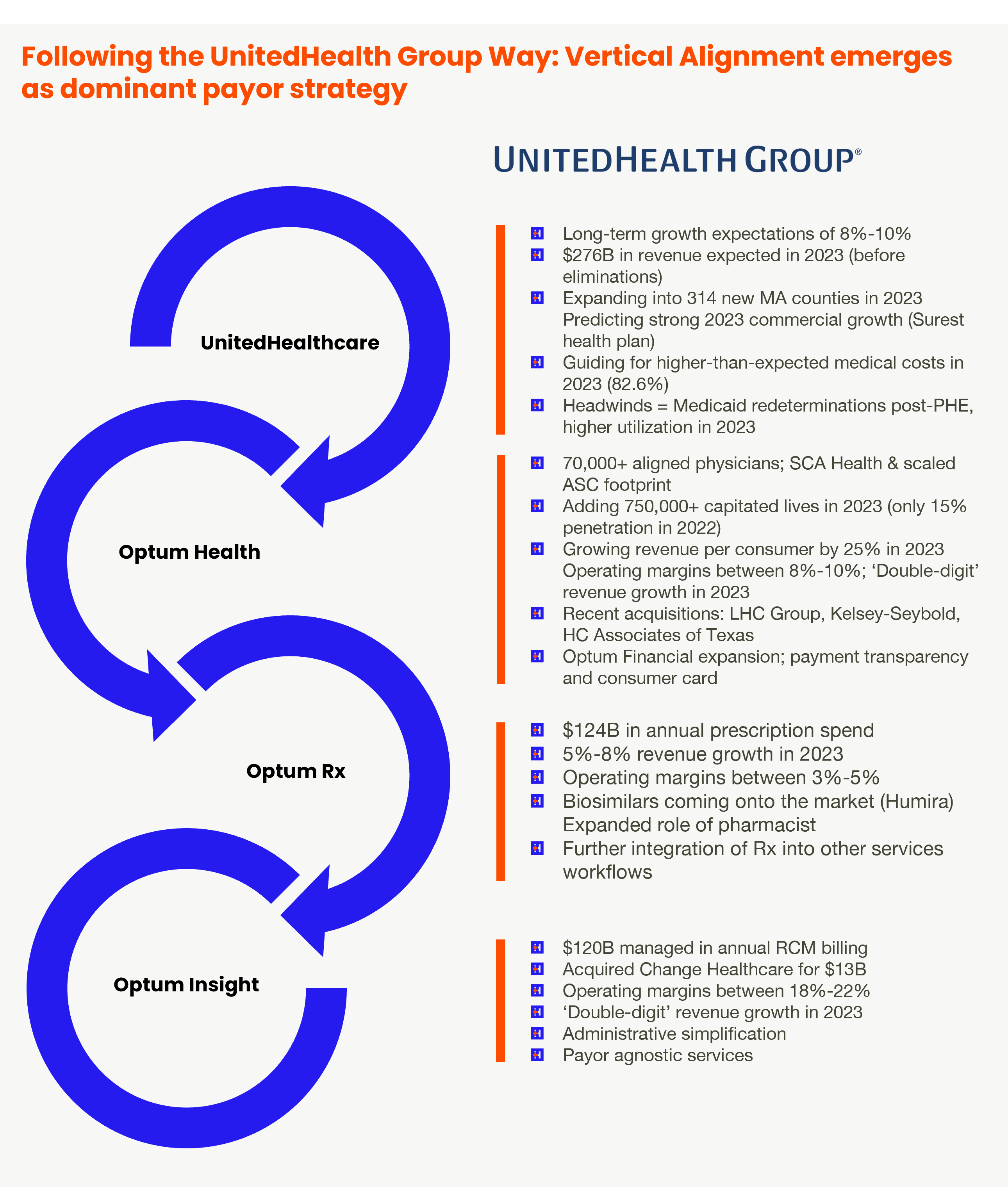

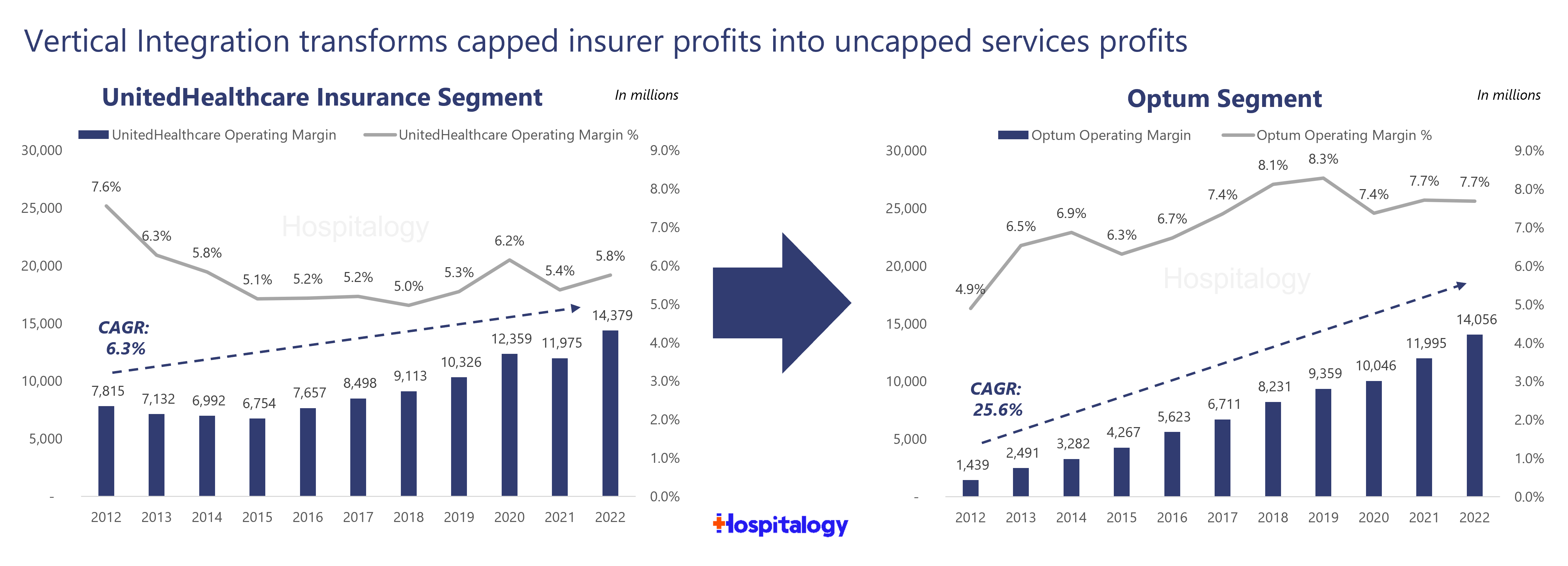

Payors are chasing UnitedHealth Group and the Optum strategy. The shift toward vertical integration means that insurers are moving profits from regulated, capped insurance segments downstream into higher-margin, unregulated, uncapped services entities.

Blake’s Take on CVS-Oak Street Health

In isolation, CVS overpaid for Oak Street Health. But CVS will benefit in the long-term – this is a decades-long bet in healthcare and MA. As such, CVS did not value Oak Street Health on its standalone value today, but rather its strategic value to CVS as a whole.

The Oak Street Health, Summit Health, and One Medical transactions by strategic players are huge net-positives for tech-enabled services companies in the risk game. They establish immediate credibility for both at-risk primary care and players dabbling in specialty risk.

Like I stated in the 2023 predictions piece, vertical integration is the dominant trend in 2023. Payors will continue to pursue vertical integration strategy until the FTC someday pries their services arms from their cold, dead hands.

CVS-Oak Street Health Deal terms & announcement

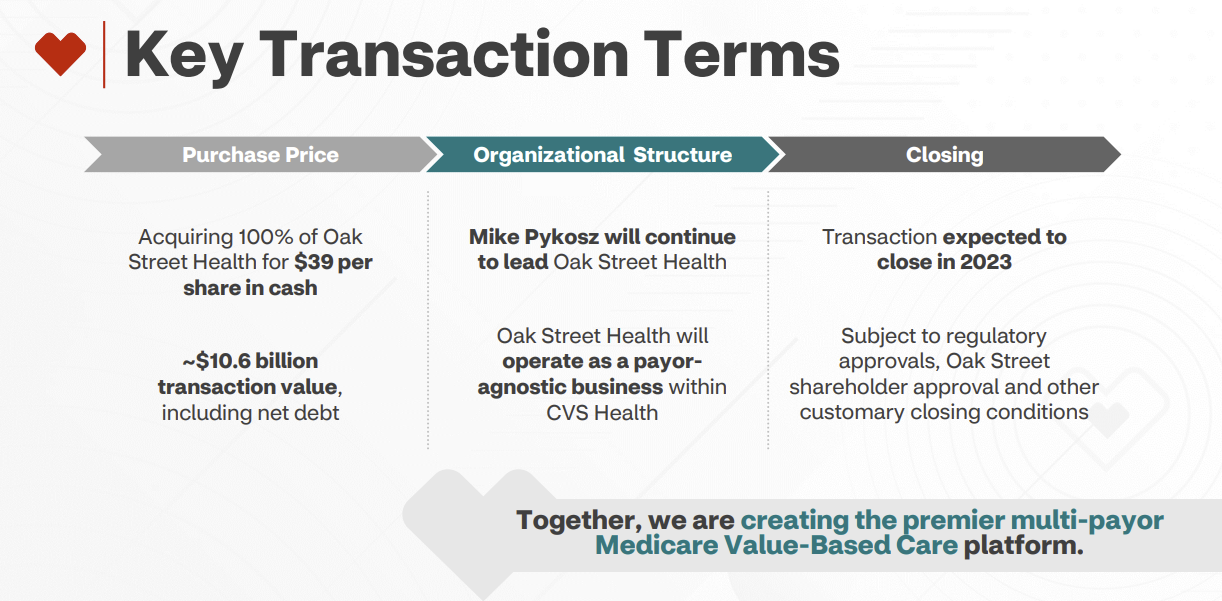

On February 8, 2023, CVS Health announced its intention to acquire Oak Street Health (”OSH”) for $10.6 billion in an all-cash deal, or $39 per share and a robust 3.4x revenue multiple on 2023 estimated revenues north of $3 billion.

The deal marks a continued frenzy for primary care integration and vertical alignment among payors. We’ll get into all of that in a bit.

But first – Who is Oak Street Health?

The Oak Street Health Business Model

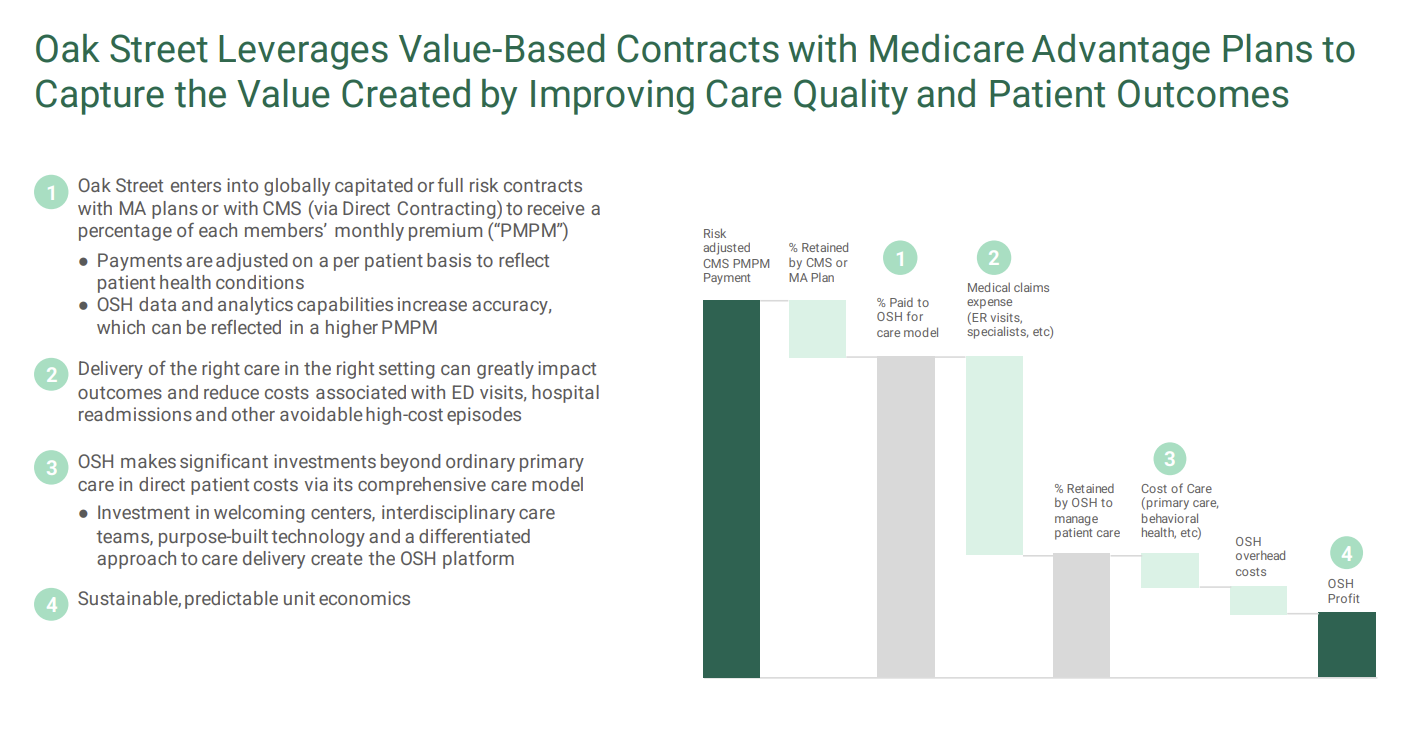

From a high level, Oak Street Health’s business model breaks down like this:

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

- Open a clinic targeting a high-need area in the Medicare population;

- Contract with payors and CMS to manage beneficiaries (Medicare Advantage and CMMI programs). OSH usually enters global capitation arrangements, meaning it’s in control over all aspects of that patient’s care – AKA, takes on ‘risk’;

- Attract patients to its clinics and transition those patients from fee-for-service to risk arrangements;

- Use proprietary tech and integrate care delivery to manage the total medical expenses for those beneficiaries;

- Make money by saving more than the medical expense benchmark, increase patient satisfaction, provide better outcomes at lower costs;

- Repeat this over several clinics and several markets.

Here are some nice slides from Oak Street Health’s recent presentations that capture its model well:

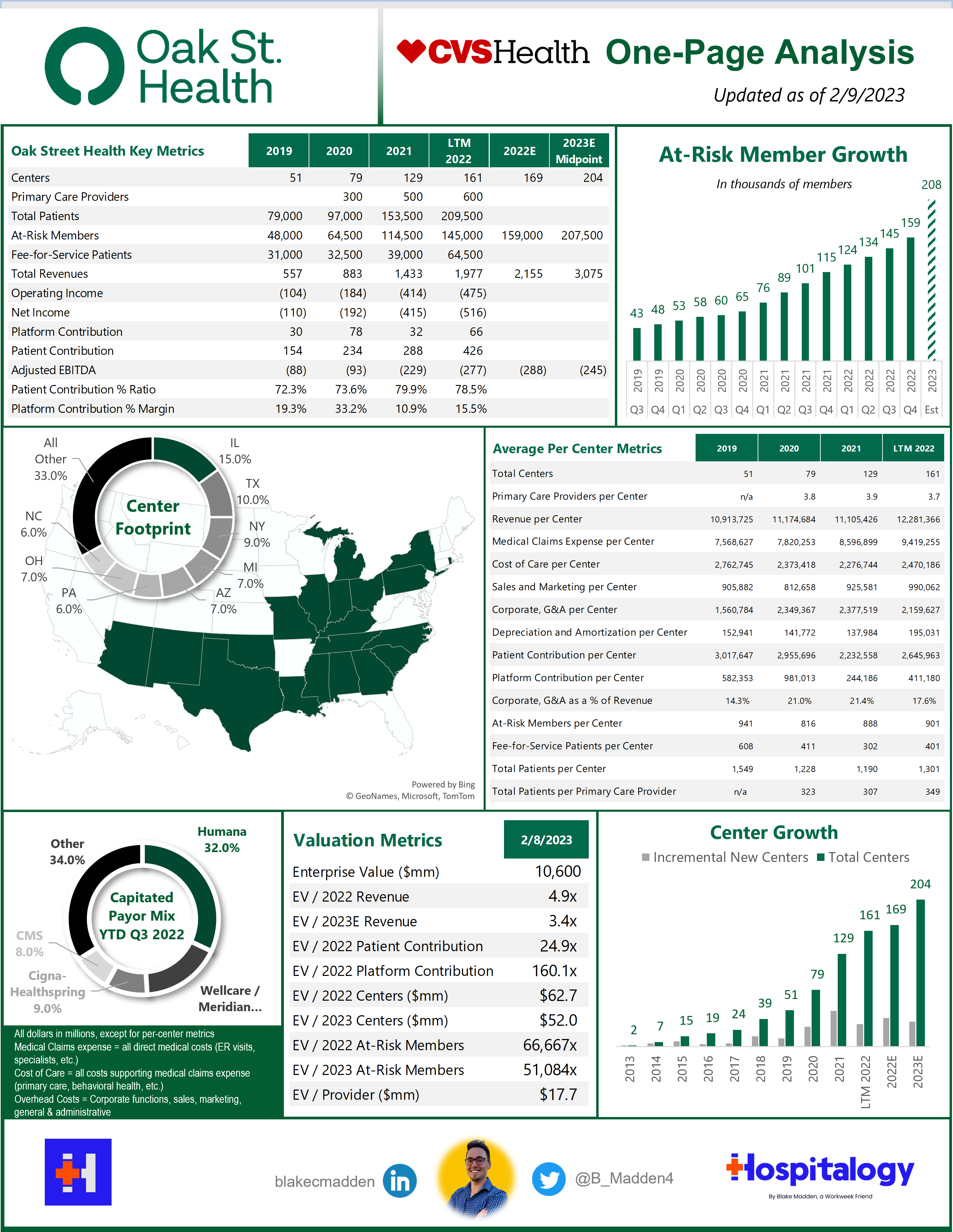

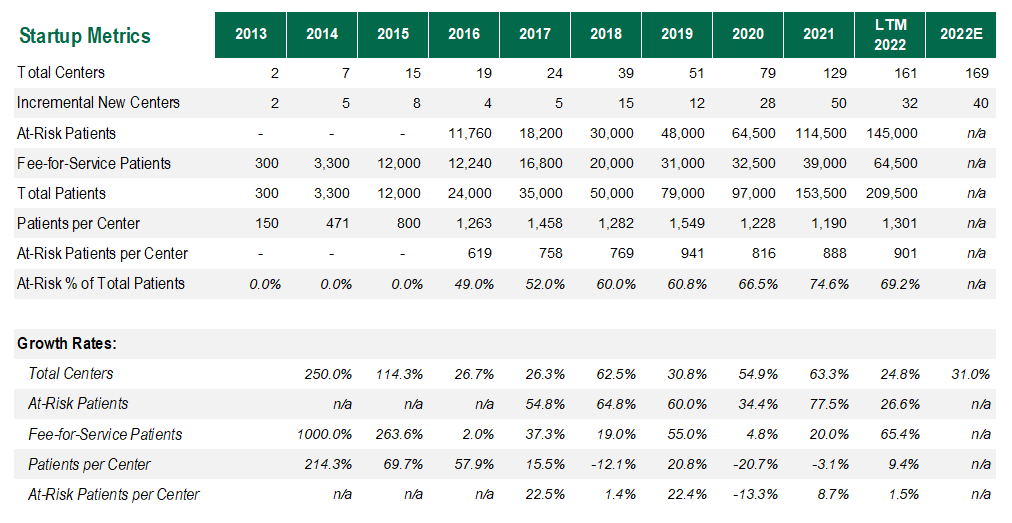

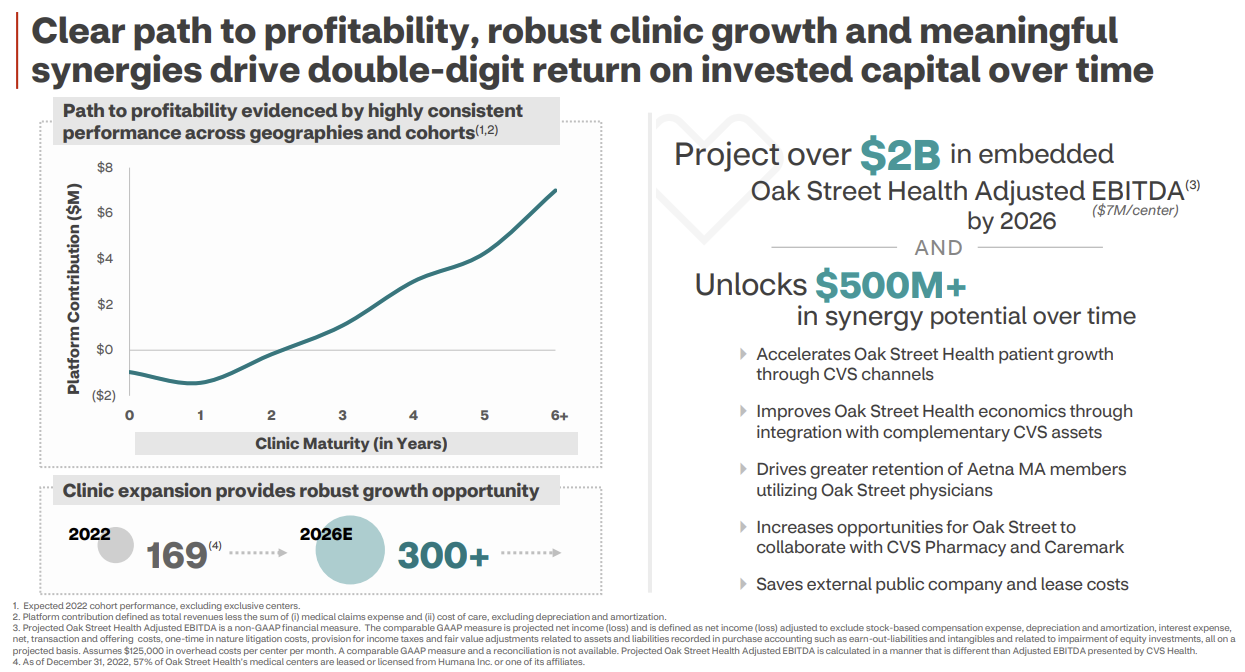

Clinical Model and Growth: Oak Street Health’s care delivery model is tightly aligned with a pointed focus on longitudinal care. To this point, for center growth & expansion, OSH does not pursue a ‘buy’ strategy. Every single center that OSH operates was built from the ground up to focus on quality and consistency from center to center. Based on this deliberate approach, OSH has grown from 2 centers in 2013 to 169 by the end of 2022, with expectations to hit 204 centers by the end of 2023 and 300+ by 2026.

The biggest way to move the needle in risk is to reduce acute events, and Oak Street Health holds a stellar track record there. As you can see below, clinical outcomes are phenomenal: 51% reduction in hospital admissions, 42% reduction in 30-day admission rate, 51% reduction in ED visits, and quality results well above key chronic disease benchmarks. Meanwhile, OSH’s other core pillar is patient experience. With reduced panel sizes of ~500 per primary care provider, OSH holds a Net Promoter Score of 90 among patients, and 95% of its providers recommend OSH as a great place to work, helping to retain providers and ease staffing pressures that are so prevalent in 2023.

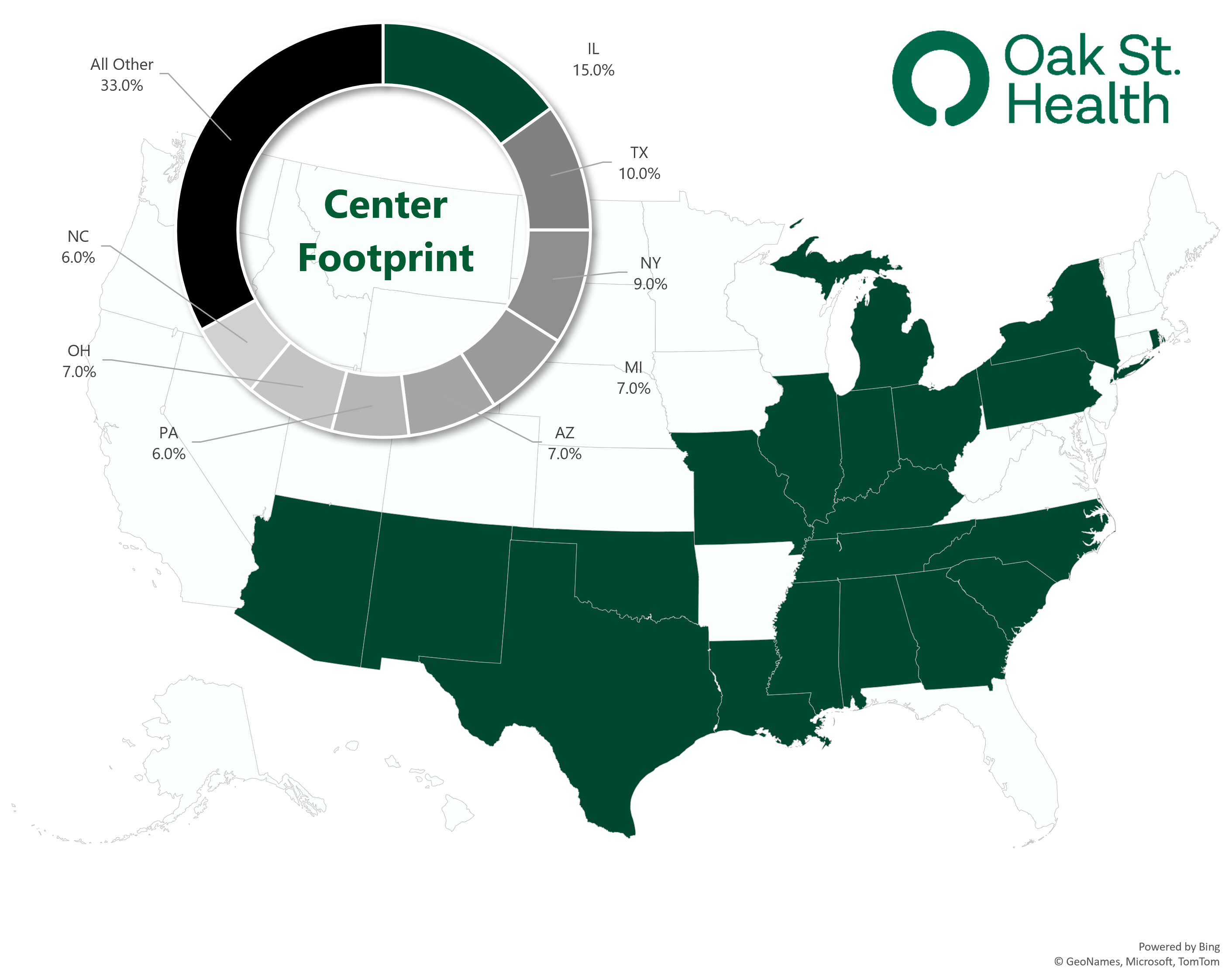

Operating Footprint: As of 2022, Oak Street Health operated through a footprint of:

- 169 well-placed clinics in 21 states (I use centers and clinics interchangeably);

- 600 primary care providers (delineation between physicians and APPs not noted);

- Interdisciplinary care teams (behavioral health, specialty care, home health, telehealth, social workers, call center, etc.) including its 2021 acquisition of specialist telehealth platform Rubicon MD – providing it access to a key lever in managing total cost of care through specialist referral; and

- Its proprietary, custom-built tech platform and electronic medical records system, Canopy (for which it has won multiple awards). Canopy is key to OSH’s operation, collecting longitudinal patient data, providing population health analytics, and creating comprehensive reviews of OSH target demographics based on the populations it wants to serve. Does that sound familiar? Carbon Health also has a proprietary, custom-built EHR. CVS also just invested in Carbon. More on that in a sec.

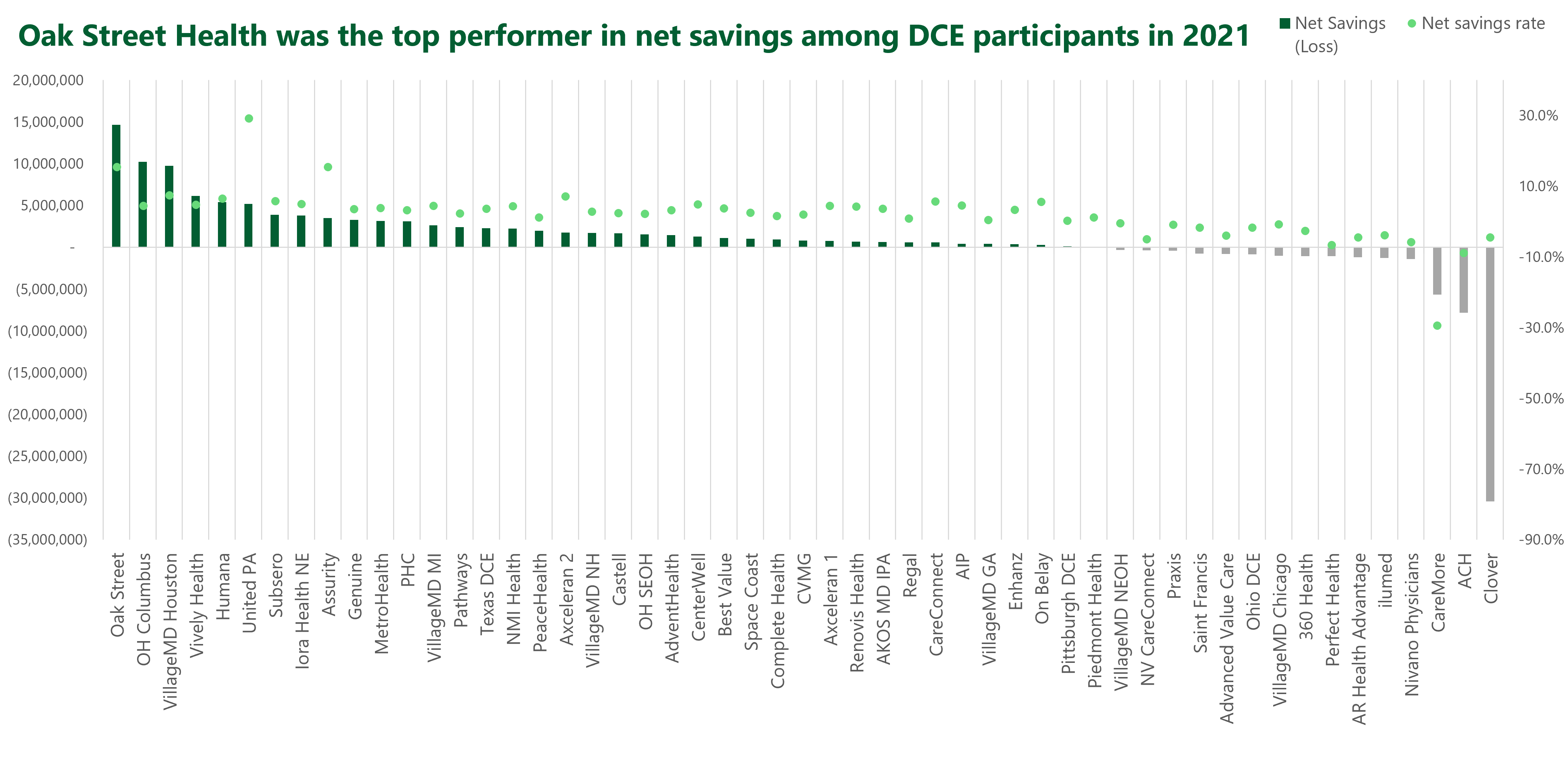

The operating results speak for themselves. Oak Street Health’s ACO was among the very top performers in savings generated and savings rate. Meanwhile, it was THE top performer on total net dollars saved in CMMI’s direct contracting program in 2021:

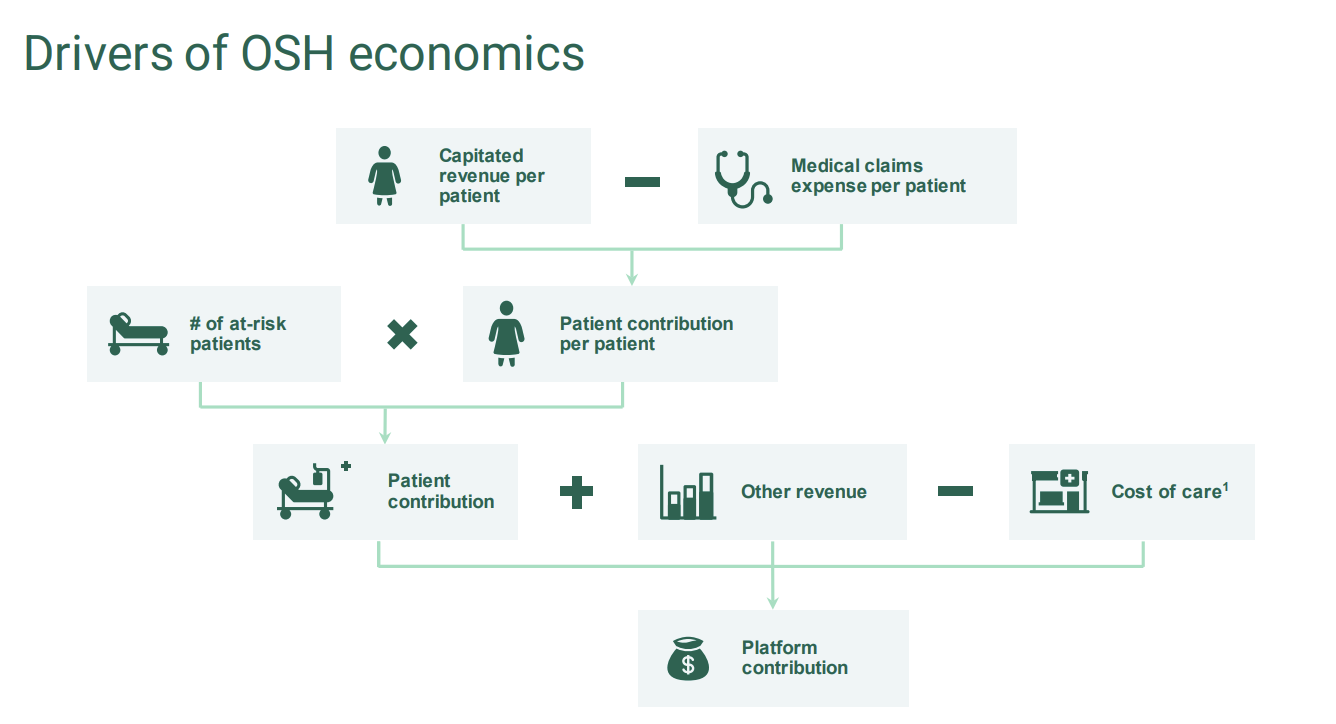

Financials and Profitability: It’s well established that Oak Street Health is a value-based care darling and has the outcomes and savings results to prove it. But the financial and profitability side gets a bit dicey.

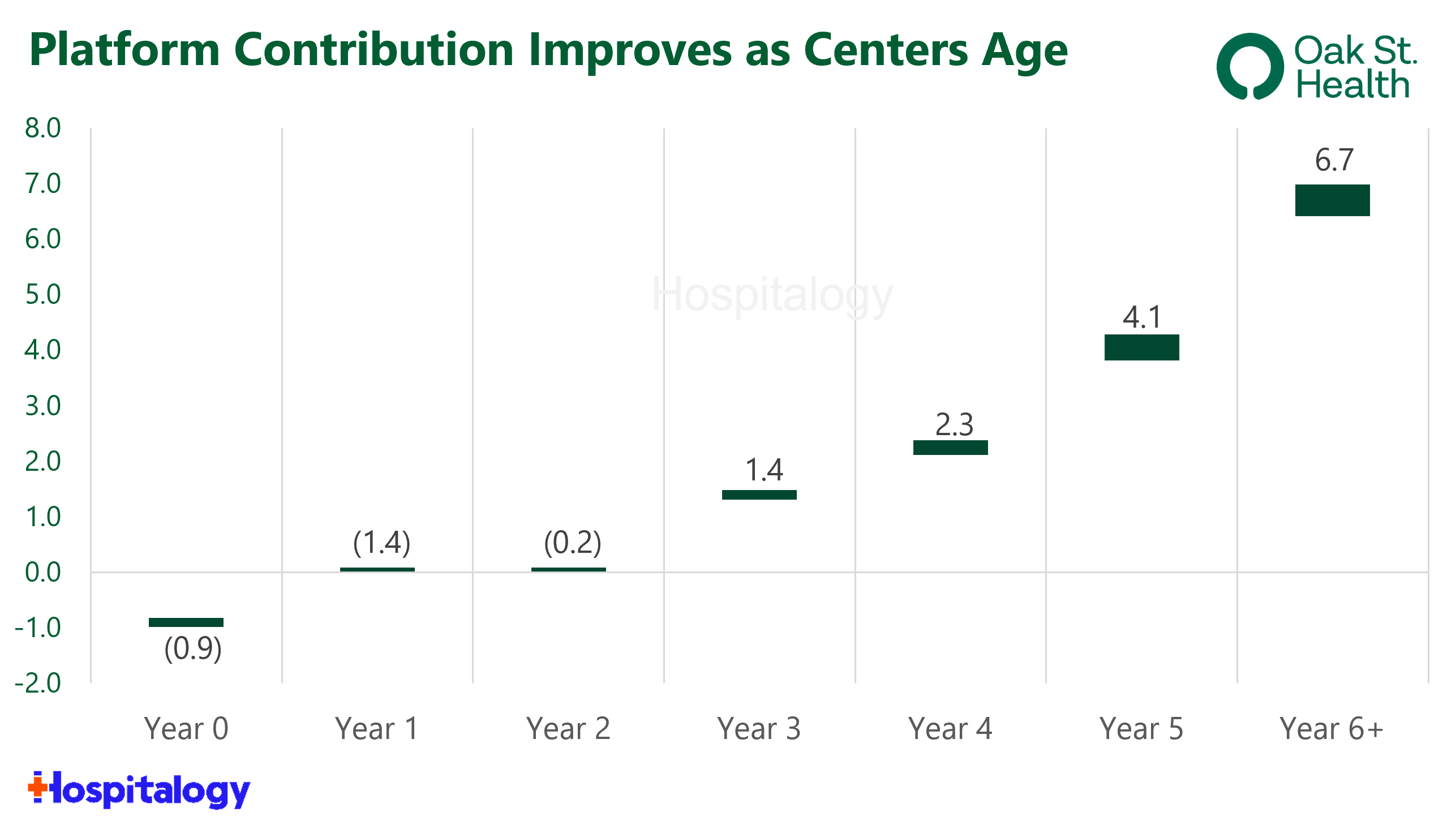

Here’s the thing with risk-based services businesses, especially one with OSH’s model (massive risk revenue, targeting high-risk populations, and therefore lower gross margins): They need time – and financial resources – to scale. Oak Street Health doesn’t expect new clinics to breakeven on contribution margin – AKA, platform contribution – until Year 3 of operations:

So when OSH went public in August 2020 and proceeded to build around 100 new clinics, funding those startup losses created a cash crunch – especially as the narrative shifted away from tech enabled services post-Covid. You can see just how much cash Oak Street Health needed to raise in order to fund operations and growth, raising new capital and diluting shareholders every 3 months or so:

- In its IPO August 2020, OSH raised $328M;

- In December 2020, OSH announced a secondary equity offering of around $260M;

- In February 2021, OSH announced a secondary equity offering of over $600M (at this point, its stock was near all-time high’s;

- In March 2021, OSH raised $800M in convertible debt due in 2026;

- In May 2021, OSH announced a secondary offering of around $750M (raising at all-time high’s). It used some of that cash to acquire RubiconMD for $130M or so. From this point, things were good for a while on the capital front;

- In August 2022, OSH announced a secondary offering of $180M.

- Finally, in November 2022, OSH opened a $300M credit facility.

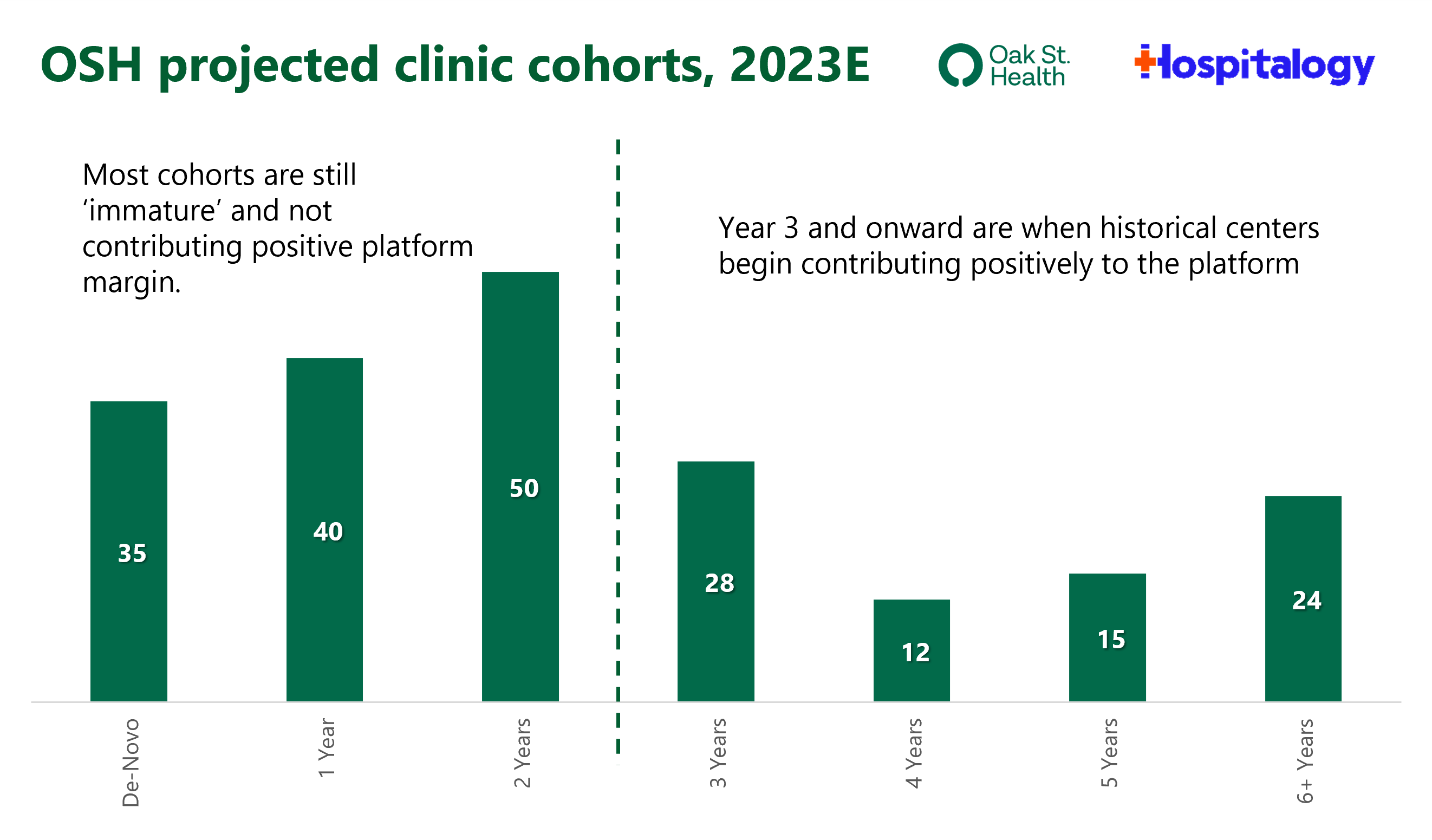

Meanwhile, most of Oak Street Health’s de-novo clinics are in Year 2 or 3 of operations – immature cohorts as far as risk is concerned. So even though the investment thesis was intact, OSH still had to appease investors about the long-term vision all the while macro economic conditions were deteriorating throughout 2022. All of a sudden, focus on profitability became a pressing concern.

The dilemma that was facing OSH management:

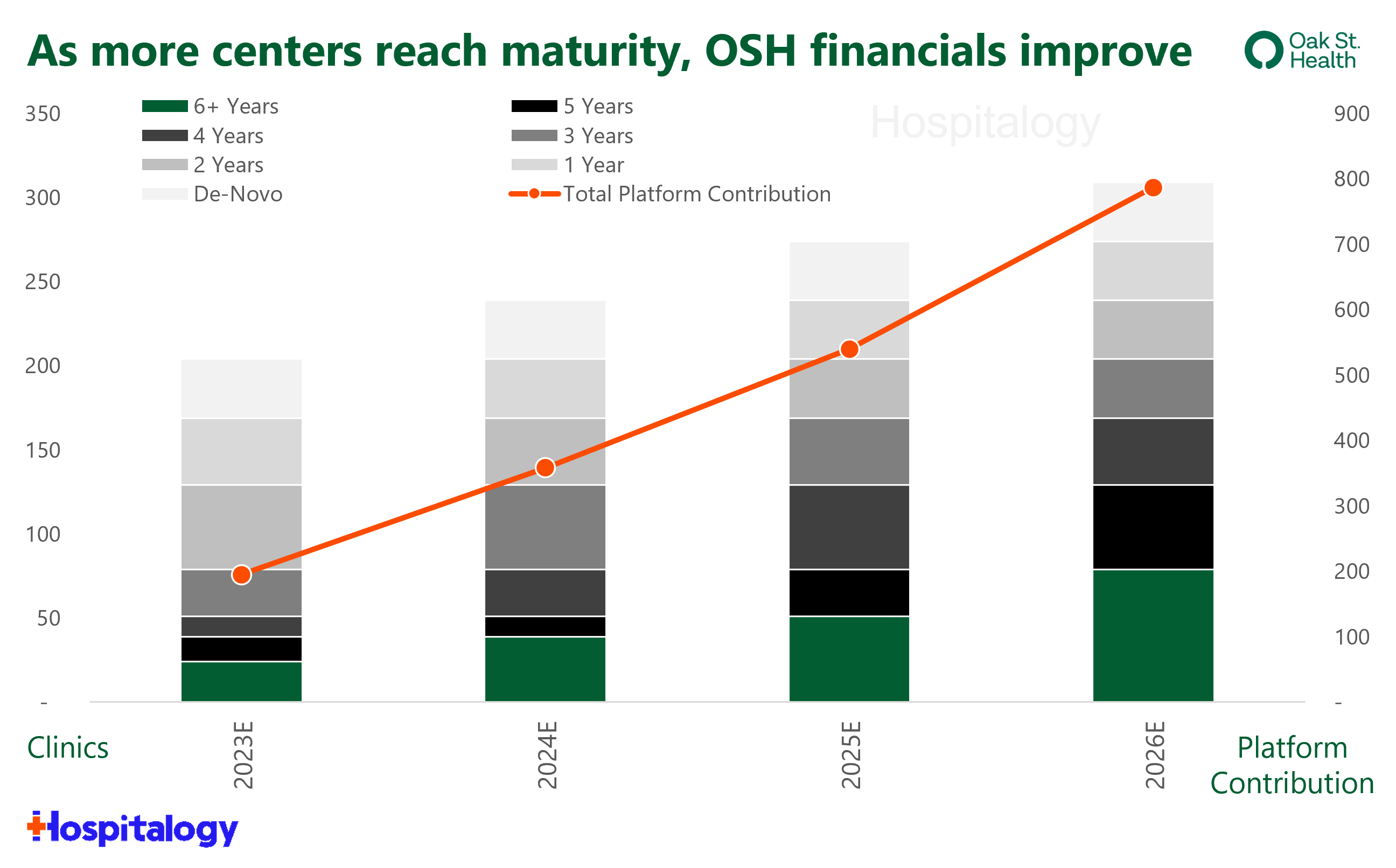

And here’s the investment thesis that OSH management continued to present, as late as the JP Morgan healthcare conference. As clinics mature and patient panels grow, platform contribution, and therefore overall profitability, increases:

Oak Street Health has even developed its own custom profitability metric – Embedded Adjusted EBITDA – which shows adjusted EBITDA performance in the scenario when all clinics reach maturity. Under this scenario, OSH hits $1.4B – or $7.0M per center – in adjusted EBITDA.

I should note that not everyone (bears, in particular) do not believe the ‘cohort’ thesis here – that is, that all maturing clinic cohorts will reach the same $6.0M-$7.0M in platform contribution. To be sure, it can prove difficult to be profitable managing total cost of care when OSH is only directly providing 5-10% of that care.

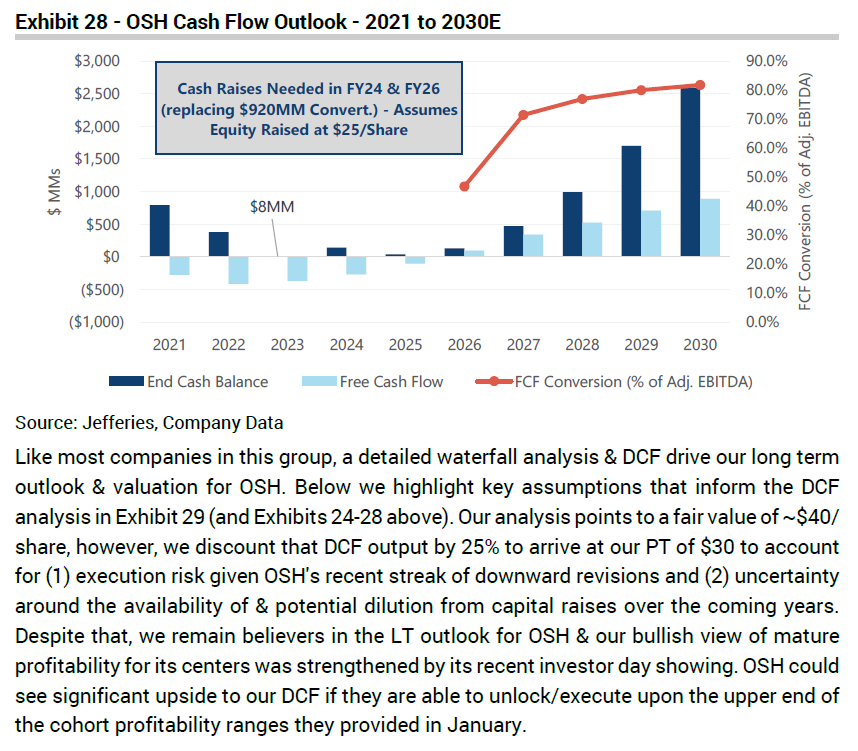

Short-term Headwinds: Oak Street Health needed more capital to fund operations in an increasingly untenable environment. While at the beginning of 2022 OSH expected to open almost 200 centers, it quickly revised that estimate down to 35 total de-novo openings. To add to this, in a March 2022 note, Jefferies projected that OSH would’ve needed another $1.3 billion in funds in 2024 and 2026 to reach positive cash flow by 2026:

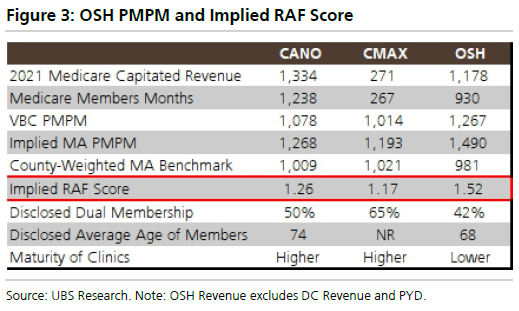

Further, based on the populations it serves (dual-eligibles, multiple chronic conditions, etc.), Oak Street Health commands some of the highest per-member-per-month rates among value-based care players. In another note, UBS backs into OSH’s implied risk adjustment (RAF) score at 1.52:

There’s nothing wrong with this – 90% of OSH clinics are located in medically underserved areas with average incomes below 300% of the poverty level – other than to call out the recent Medicare Advantage rate headwinds and risk adjustment changes, which would imply that OSH potentially has higher exposure to RAF changes. Of course, lower risk scores would lower financial performance for OSH, decreasing platform contribution and increasing ramp-up time for de-novo clinics. In that same note, UBS goes on further to say that based on analyst conversations with large MA plans, long-term adjusted EBITDA margin targets likely sit between 10-15% rather than its stated 20%.

All of this considered in the short-term, it makes sense to me why Oak Street Health sold. Especially at the nice premium CVS offered. Give those bankers a raise.

But on the CVS side, why did they bite on Oak Street Health? Long story short: they buy the value-based care thesis, especially given its very positive downstream effects on the rest of the CVS business. And they had major FOMO.

CVS Health Strategy Breakdown

Background: CVS Health management has been very vocal about its desire to buy a national, scaled primary care platform. Their openness turned out to be a thorn in their side over the past year and a half. In 2022, it whiffed on One Medical, then saw public & private primary care assets bid up based on speculation and the amount of strategic buyers in the market.

In late 2022, CVS witnessed an $8.9B VillageMD-Walgreens-Cigna/Evernorth deal to acquire massive multispecialty provider Summit Health.

Also in late 2022, CVS hired a new President of Care Delivery Amar Desai who used to be the CEO of Optum’s Pacific West Division. Prior to that, he was the President of HealthCare Partners (part of Davita Medical Group which then sold to Optum), a clear signal that CVS was getting serious about its integrated care delivery strategy across retail health, chronic disease management, and behavioral health.

2023 began, and CVS announced a $100M investment in Carbon Health – a very nice off-balance sheet primary care play. The move led me to believe that CVS would pursue smaller deals and possibly a ‘build’ approach given the scarce number of scaled risk clinical assets along with a rumored failed Cano Health deal in October 2022. I went so far as to say that a deal between Oak Street Health and CVS wouldn’t happen.

Then CVS went and bought Oak Street Health. Welp, can’t win em all.

So, with that aside, here’s why CVS wanted to buy Oak Street Health. Really it’s all about Medicare Advantage. Through the following avenues, CVS has identified at least $500M in deal synergies (there’s that ‘embedded adjusted EBITDA’ metric again, smh):

To Increase MA Star Ratings: Every year, CMS releases star ratings for MA plans. The star ratings are based on a variety of inputs that are supposed to reflect the experiences of the consumers that had those plans in the past. It’s a big deal for plans to get a 4-star or higher plan, since CMS issues a 5% quality bonus for plans above that threshold. Unfortunately for CVS, its largest Aetna Medicare Advantage plan dropped below that 4-star rating. The event was material enough for CVS to issue an 8-k related the news.

- Boosting star ratings are a major point of emphasis for MA plans in 2023, as ratings saw a large drop in 2022. While 87% of CVS’ MA plans were 4-stars or higher in 2021, just 21% of its plans will hold a 4-star or higher rating in 2022. It’s a sizable hit to profitability – around 4% to 5% of earnings in 2024. You can see why CVS wanted to do something quickly about this hit.

- Because CMS is increasing the star ratings focus on patient experience, complaint, and access measures (CAHPS), CVS needed an asset in MA that, well…enhanced patient experience. And who better than Oak Street Health there?

To boost patient engagement, market share, and risk scores: Combined with Signify Health, CVS will hold two assets to perform in-home assessments, engage with patients, and boost member experience with the ultimate goal of member retention. Plus, more longitudinal patient data serves to optimize RAF scores and helps big-time with care coordination and provider/patient satisfaction. CVS is struggling with its individual MA growth.

To turn a third-party operating expense into a related-party revenue stream: We’ll be diving into payor vertical integration tactics in just a second, but by acquiring Oak Street Health, CVS transforms a third-party operating expense into a revenue and (someday) potential profit center. Plus, access to CVS capital will afford OSH the ability to borrow easier and accelerate its growth from 35-40 clinics per year upward from there.

To preserve pharmacy market share: Self explanatory, but CVS Caremark did lose its Centene contract – covering $35 billion in spend – to Cigna’s Express Scripts.

To Keep up with the Joneses: Everyone is chasing Optum. Plus, CVS can’t sit on its hands and watch Walgreens stumble into success with VillageMD-Summit.

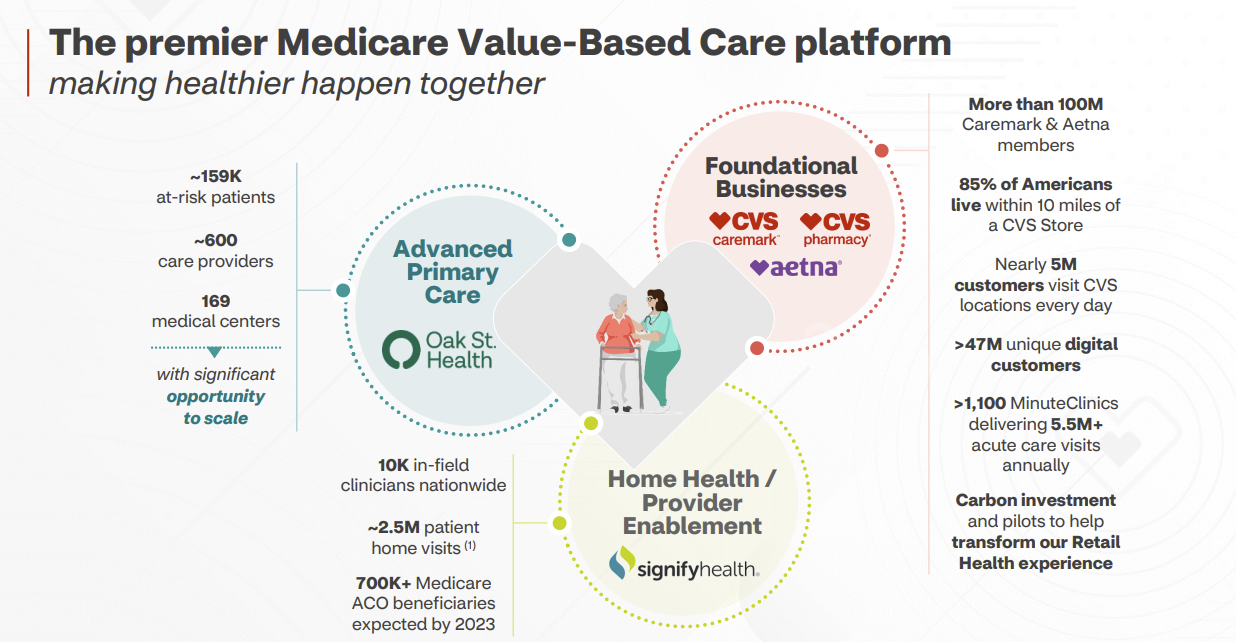

Big picture primary care strategy: Now, with Signify-OSH-Carbon combined with Aetna, Caremark PBM, and 1.1k MinuteClinics, CVS holds a formidable care delivery platform. That is, if all of these deals receive regulatory approval and they’re successful in integration. It’s always possible there’s a culture shock, and people don’t necessarily feel fondly for CVS.

Over time, the CVS care delivery platform will look something like this:

- Carbon’s model to serve retail, commercial, and urgent care populations

- Oak Street Health combined with Signify IHEs, provider enablement (Caravan) to boost MA footprint and quality of its offerings – all payor agnostic, meaning that Oak Street will continue to work with Humana in its other JVs as will Signify work with other payors. Similar to Optum, these are all platforms, and CVS wants to create the ‘Premier Medicare Value-based Care Platform.’

Final thoughts: CVS may have overpaid for Oak Street Health as a standalone asset, but the healthcare behemoth will benefit in the long-term from the downstream effects of integration. It’s similar economics to how hospitals benefit from subsidizing losses on employed physician base. In return for that subsidy, hospitals receive downstream high margin services. In the case of payors, the downstream benefits for CVS will over time include higher Medicare Advantage star ratings, better Medicare Advantage member retention, pharmacy market share preservation, and other positive externalities of vertical integration, which I’m diving into next.

Notable commentary from CVS’ Q4 earnings call:

On long-term investment into MA: “On your second question, it was important to us to both understand the positioning on RADV and at least be able to see the MA advance rate notice for ’24 and, frankly, work in conjunction with Oak on what we thought that meant to them. And we’ve had the ability to do that. And obviously, as you all know, much of that still leaves many questions to be answered in the future. It does provide a little bit more clarity than we had in the past. But I think we do understand the dynamics and some of the mitigation efforts that we could put in place if certain things stand or certain things get modified.

In many ways, though, what I would say is what we saw come out of those notices, I think, is exactly why you want high-quality Medicare Advantage value-based care assets. In its most simplest sense, when you have a year, for example, when reimbursements get squeezed, what’s one of the things you want to do? You want to look at your cost control levers. And certainly, Oak is a demonstrable asset that has proven to improve outcomes and reduce costs.”

**On long-term capital deployment in regard to Signify and OSH: “**Our strategy has been and will continue to be to deploy capital to improve the sustainable earnings growth rate of this company as a whole. When you look at this asset in concert with Signify, we project this could improve our overall long-term earnings company growth rate by at least 100 basis points a year as these investments mature. It’s important as you think about this, that the dilution, especially the dilution from financing, is temporal and short term, but these sustainable improvements in growth rate are not.

From a return on capital standpoint, we think it earns double-digit returns on capital in year 7. And very importantly, because of the embedded value in that clinic infrastructure, that return on capital continues to grow on the order of 200 basis points a year thereafter.

And I mentioned in my remarks that, at the current rate of expansion, we would expect to have 300 clinics by — in 2026 or by the end of 2026. And using the Oak Street convention around adjusted EBITDA at $7 million per clinic, we think the embedded EBITDA could cross the $2 billion threshold in the 2026 year. So that’s an important sort of data point. But I think it’s important to recognize that the way that embedded EBITDA really manifests itself can be in these ongoing returns on capital.

I’d comment that, while the return profile might be longer than other deals you’ve seen in the past, I don’t think it’s atypical of deals that meaningfully improve your strategic positioning as a company. And I do think it’s important — in fact, I think being overly slavish to deals that only satisfy short-term returns are exactly what can lead to long-term growth problems. And I think we’re — this is something that has a lot of long-term growth to earnings power.

And finally, you had asked about the synergies and some of the kind of accretion dilution. The synergies are powerful here, and I think it’s one of the things that we’re uniquely positioned to deliver on. I’ve often — when I’ve talked to all of these companies, they’ve often said to me like, if I say, “What do you need to grow faster?” And they say, “Members and capital,” well, that’s something we can bring to bear here.

But most of the synergies, probably about 70% of what we talked about, are tied up really in that accelerated growth and the improved retention of MA members. And so when you think about the model here, the J curve, if you will, this is about moving them along that curve faster. And in that trajectory, that generally gets closer to breakeven and positive in that year 2 to 3 time frame. So that it’s after that, that a lot of these synergies mature.

The way we see that playing out is, I think this would be roughly EPS-neutral probably in like year 4 of our ownership or thereabouts, and begin to be accretive on an EPS line for year 5. But make no mistake, it is improving each year, which is going to help our growth rate between then and now, and you’re building substantial embedded long-term value in that footprint.”

Vertical Integration is the Key

There’s a reason why I noted that vertical integration would be a key area to watch in 2023 and beyond. It is far and away the dominant strategy for payors, who continue to double down on services investments.

What’s the key here though? It’s all about services. Services unlock profits for insurers. Looking at UnitedHealth Group, for example, you can see the transfer of profit and cash flow to Optum – whose profits are uncapped and unregulated – when compared to UnitedHealthcare – whose profits are capped and regulated by the ACA.

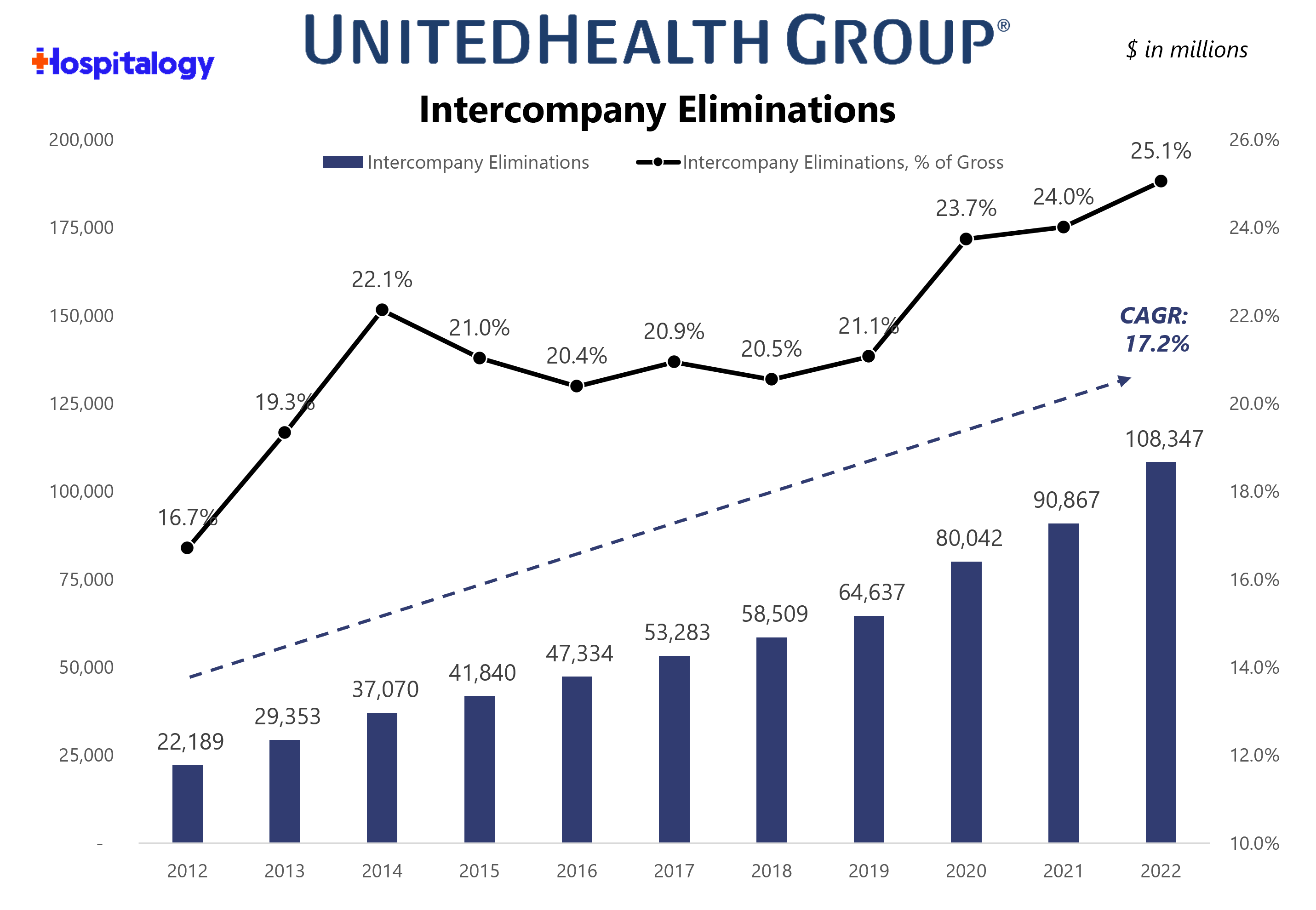

Through intercompany eliminations and the movement of money enabled through vertical integration, UnitedHealth Group’s organizational structure and long-term bet on Optum drives growth in the bottom line for the broader organization.

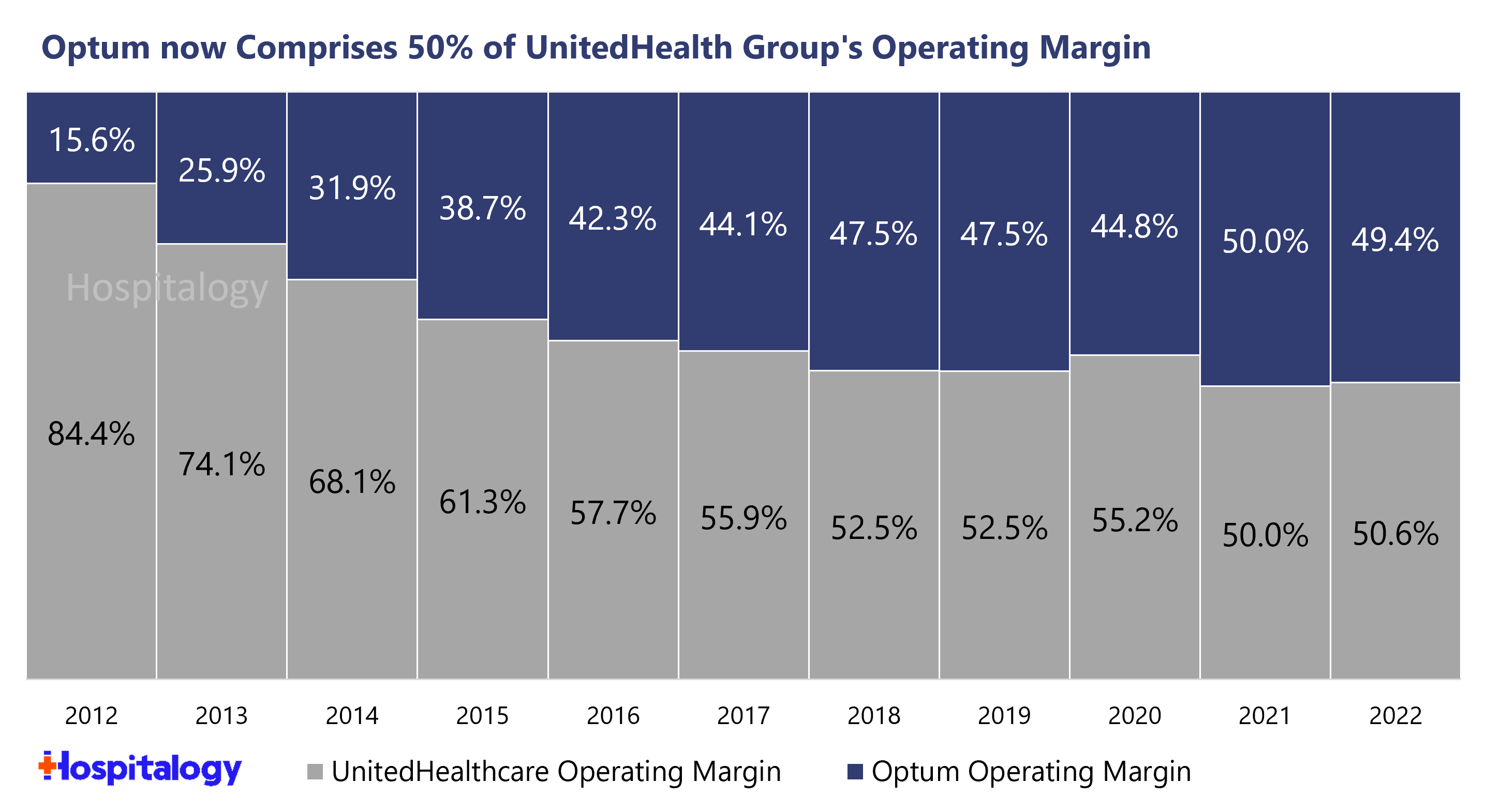

In fact, Optum now comprises 50% of operating margin, up from 15.6% 10 years ago:

It’s really a no brainer strategy for payors to pursue, which is why you will most definitely see CVS win in the long-term despite paying an egregious premium for OSH upfront. It’s a decades-long investment philosophy, but barring any major disruptive changes to healthcare, it’s a winning one. The economics of risk work way better in a fully integrated care delivery model as opposed to a standalone primary care player. Look for payors to continue to make strategic acquisitions across their portfolios (Humana-CenterWell, United-Optum, CVS-CVS Care, Cigna-Evernorth). Payvidors will continue to win.

Implications on VBC players and Venture

The Oak Street Health, Summit Health, and One Medical transactions by strategic players are huge net-positives for tech-enabled services companies in the risk game. For anyone building in these markets, they establish immediate credibility for both at-risk primary care and players dabbling in specialty risk, and are nice multiples among a sea of strategic buyers currently in the market for assets like these.

To add to this, scaled value-based care operators that can be acquired are now scarce assets. Cano Health, CareMax, ChenMed, and perhaps a handful of others come to mind as the final few in the first wave of tech enabled risk players. It’s possible that the final few get acquired or assimilate further into existing payors. Because otherwise, as payors scale their risk and clinical operations, it will be tough sledding for these ‘unaffiliated’ standalone players to compete against better capitalized, vertically integrated healthcare behemoths like CVS, Humana, and UnitedHealth Group.

Parting thoughts

Like I’ve mentioned before, I’m surprised this deal happened, but now that I’ve done a deep dive on the acquisition I can see the long-term play. Emphasis on long-term. CVS will incubate and accelerate OSH’s clinic growth, all while focusing on its broader primary care strategy and enhancing its Medicare Advantage strategy.

Before leaving, I received some interesting commentary from subscribers and followers on the implications for healthcare at large:

Rick Goddard from Lumeris isn’t surprised to see payors continue to vertically integrate: “corporate vertical integrator companies (VICs) are mirroring each other’s large price points for a primary care base. VICs are focusing on acquiring national footprints given their national payer/retail/urgent care presence. But primary care is the base of taking total cost of care risk and they need it to coordinate up and down their vertical value chain on an aligned business model.”

From an integration perspective for VICs, Rick had some open ended questions:

- “With this vertical integration scale, will these VICs move up and down the chain to culturally bind one another to coordinate care, access, and plan design effectively? It’s always tough sledding in the early days of integration but once the buy spree is over- are they a well-oiled, consumer-driven, business model ready to capitalize on the market share they have?”

And there are also some interesting takes on my tweet about the deal – check it out here.

What are your thoughts on the acquisition? Reply to this e-mail and let me know what you think. If there’s anything you think I missed, or any other implications to include, I’d love to hear your take.

That’s it for this week! Join 18,000+ executives and investors from leading healthcare organizations including Privia, ApolloMed, and HCA Healthcare, health systems including Providence, Ascension, and Atrium, as well as leading digital health firms like Cityblock, Oak Street Health, and Turquoise Health by subscribing here!

Resources and Footnotes:

What Oak Street Health got right (BS)

CVS Health events & presentations (CVS)

Amazon and One Medical: are we there, yet? (Hospitalogy)

CVS and Oak Street Health: I was wrong (Hospitalogy)

What to know about the CVS-Carbon Health deal and what it means for Healthcare. (Hospitalogy)

8-K filing from Oak Street Health (PDF)

CVS-Oak Street Health investor presentation (PDF)

CVS Q4 and full year 2022 earnings (CVS)

Oak Street Health’s JP Morgan Healthcare Conference presentation (PDF)

Healthcare Vertical Integration: Back to the Future (Lumeris)

2 critical steps will make or break CVS’s acquisition of Oak Street Health (CI)

Acronyms, Vocabulary, and Terms to know:

Healthcare acronyms suck. Here are key acronyms and terms to know:

RAF: Risk adjustment factor (Learn more)

MA: Medicare Advantage

ACO REACH: CMS’ new value-based care program – the successor to CMMI’s direct contracting program. (Learn more)

Payors or Insurers: Used interchangeably to mean health insurance companies – although many of them provide much more than insurance these days. We need a new word. Payvidor? Health conglomerate? Behemoth of epic proportion?

Payvidor: A hybrid business model that provides healthcare services but also manages risk (Learn more). This is a type of vertical integration in which payors own care delivery assets.

Payors to know: UnitedHealth Group, Humana, CVS/Aetna, Elevance, Cigna

Risk-Based Services players to know: Oak Street Health (OSH), One Medical, Summit Health, Cano Health, CareMax, ChenMed, JenCare, Agilon, Aledade, Privia Health, ApolloMed,

CVS: Consumer Value Store (bonus points if you knew that, I included it for fun)

Dual-eligibles: people enrolled in both Medicare and Medicaid who are eligible by virtue of their age or disability and low incomes. (Learn more)

Platform Contribution: An Oak Street Health metric that depicts center-level profitability, but prior to accounting for corporate overhead expenses. Helps investors to understand clinic and value-based care unit economics

EBITDA and Adjusted EBITDA: Earnings before interest, taxes, depreciation, and amortization. Often used as a proxy for cash flow and a very common metric used in valuation. Adjusted EBITDA is similar, but it’s a metric that financial folks & bankers use to adjust or normalize for ‘non-recurring’ items and stock-based compensation.

Embedded Adjusted EBITDA: An internal OSH metrics that provides investor with a view of center profitability assuming that all centers are in the ‘mature’ clinic cohort and producing a platform contribution similar to what they’re seeing from currently mature clinics.

That’s it for this week! Join 18,000+ executives and investors from leading healthcare organizations including Privia, ApolloMed, and HCA Healthcare, health systems including Providence, Ascension, and Atrium, as well as leading digital health firms like Cityblock, Oak Street Health, and Turquoise Health by subscribing here!