Hospitalogists,

Today is a fun one! I’ve been chatting with Commons Clinic co-founder Nick Aubin for a while now, and he’s given me the go-ahead to share some exclusive news with you guys so you hear it first through Hospitalogy.

Commons Clinic is making a major investment – $9.75M – into the independent advanced spine surgery center Marina Orthopedic & Spine Institute. Along with the investment, Commons Clinic is launching its proprietary, integrated ASC platform Theater to enable best practices, scalability, and automation across facilities. Both are integral parts of the Commons Clinic vertical integration strategy.

Along with that announcement, I’m also taking a dive into the Commons Clinic model and why their team is well positioned along a number of tailwinds in healthcare – a new partnership model for orthopedists, movement toward value-based specialty care, growth in orthopedic procedures, and vertical integration.

Note this is not sponsored. The Commons Clinic model, as a version 2.0 of Oak Street Health, fascinates me, and I’d like to continue to highlight startups doing interesting things across healthcare.

Let’s take a little dive into the Commons Clinic playbook and their goal of introducing major competition against incumbent health systems. For my hospital & health system audience, tongue in cheek title aside, these new players are what you’re up against!

The Commons Clinic Thesis (AKA, the New Cleveland Clinic): Build a dense, closed loop, vertical system within orthopedic care. Drive value and be a good partner for physicians. Provide a superior, transparent experience for patients. Leverage operating efficiency & technology along with exorbitant health system rates on specialty procedures to create episodic bundled payments with payors to generate margins + capture market share shifting to the outpatient setting.

Step 1: Win Physician Hearts & Minds (and Pocketbooks)

Healthcare starts with the physician-patient relationship. The number one goal of any healthcare organization or enablement should be simple…Be a good partner to physicians, and a good steward for patient care.

Good partnerships are easier said than done, especially with physician employment dynamics today.

While overall compensation is increasing, professional reimbursement is declining, meaning physician consolidation is accelerating as independent practice grows untenable. Productivity models today result in overutilization and burnout. Plus, physicians want to build wealth – not be commoditized cogs in the corporate machine. We need new pathways for physicians to find agency and good partners, but also to reform physician compensation to drive the right behaviors.

Commons Clinic holds a potential path forward, starting with orthopedists. Their model provides specialists with an alternative opportunity outside of a traditional PE rollup, or hospital employment.

The Commons Clinic physician alignment model includes ownership and agency at multiple levels:

- A path to equity in Commons Clinic Physician Partners (CCPP – the Medical Group) – which is not a typical ‘friendly PC’ model. CCPP is a GP/LP structure, meaning all of the Commons Clinic physicians are equity partners in the group. They feel like owners of their own distinct franchise.

- Ownership and distribution at the owned ASC level.

- Agency and control at the clinic level – e.g., Commons Clinic wants the doc to run his or her own clinic with minimal interference, and provides tools and support where needed.

More ownership and control over your book of business, and equity in ParentCo leads to wealth building opportunities for physicians along with traditional compensation and gainshare bonus pathways within typical enablement arrangements (shared savings, quality bonuses, etc).

Step 2: Reconfigure the Facility Stack

“Your margin reimbursement rates are my opportunity.” – Jeff Bezos, probably

In this case, I’m referring to comparatively higher reimbursement rates for health systems, high-margin outpatient procedures happening in HOPD settings (versus freestanding ASCs), and how this historical advantage works against health systems when a risk-bearing competitor enters the market.

Someone like Commons Clinic is redefining episodic-based specialty care within a tightly aligned, closed loop, vertical system. Holding a network of high quality outpatient healthcare delivery assets unlocks the ability to operate in ruthless, efficient fashion without existing legacy overhead. As a result, Commons Clinic is building a ‘focused factory’ from top to bottom in orthopedic care and holds distinct advantages over incumbent players:

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

- Vertical risk aggregation allows ownership over the entire patient experience and operating process, driving higher quality care, better patient coordination, and presenting attractive offerings for payors & employers – at high margins outside of the health system HOPD setting.

- Ownership of care delivery assets means more control over quality & processes:

- Attract and align with talented orthopedic surgeons

- Develop an orthopedic center of excellence

- Drive innovation in surgery, medtech, software development, incubate new orthopedic-focused ideas

- Present a pathway outside of traditional hospital employment for fellows – e.g., education and fellowship at the Commons Clinic Center for Spine Economics, Outcomes, and Research.

- Acquire an ASC (done as of today), and leverage that acquisition to grow your density within market, boost high-quality outcomes, control medical supplies spend, and develop leading best practices to share with other network facilities (Theater)

- Maintain and/or own a high quality network of ancillaries (physical therapy, imaging, sports medicine, etc)

- Provide exceptional patient experience and customer service through care teams, navigators, and AI to fill in other gaps where needed (call center support, risk stratification, data and analytics)

Step 3: Put a Price on it (Bundles!)

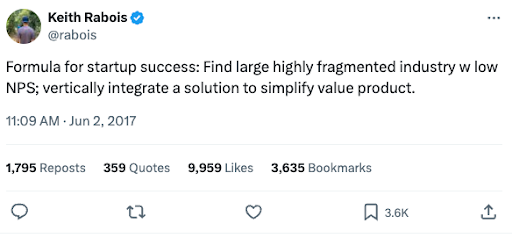

I didn’t think I’d ever put a Keith Rabois tweet into Hospitalogy, but here we are, with our ultimate ‘thinkboi’ caps on:

This concept applies directly to healthcare: local healthcare markets are highly fragmented (still! Isn’t that crazy to think about even though we constantly bemoan consolidation?) Patient experience needs to improve drastically (NPS, transparency, communication). And vertical integration of assets unlocks the ability to sell bundles and simplify unnecessary complexity in healthcare delivery.

So, because health systems hold market-leading, frothy reimbursements but also rigid, high legacy infrastructure costs, existing reimbursement rates at the hospital level intrinsically supports inefficiency.

This pricing dynamic present a clear opportunity for someone like Commons Clinic to enter a market and streamline a vertically integrated product. The concept of bundling orthopedic episodes of care for payor or employer members is an area that generates material savings but also nice margins for Commons and physicians.

Think about it. If you can optimize for every part of the facility stack with today’s technology and best practices outside of a legacy hospital expense structure, but leverage that artificially high pricing to negotiate your bundle, wouldn’t that generate material value? I (and Commons Clinic) think so. There are execution and other nuanced challenges involved, but the economics make more than enough sense.

In summary, the model that Nick & Commons are trying to create would affect stakeholders in the following ways:

- Patients: Clear product value, transparent pricing, consistent quality outcomes.

- Physicians: See step 1 above (ownership, agency, commensurate compensation and gainshare), brand and reputation, technology and tooling to succeed in risk.

- Health plans: Guaranteed savings through bundled agreements, predictable costs.

- Hospitals: Structurally disadvantaged as they cling to HOPD pricing, resistance to risk, site-neutral payments, and transparency with consumers. Physician subsidy comp model promotes overutilization and burnout

Step 4: Rinse & Repeat the Playbook

As the model proves out, Commons Clinic doesn’t want to stop in one or two markets or specialties,. There are plenty of specialties and procedures in other arenas with applicable episodic or condition that work well with bundles (cardiology being one example). Commons Clinic can leverage Theater, understand best practices (evidence-based care pathways, clinical workflows, optimal staffing models) across ASCs and promote similar cross-facility quality, proving out the value of their bundled offering to payors as Commons Clinic expands to multiple markets.

Step 5: Win the Brand War

People gravitate toward brands they trust. Trust is at a premium in 2024, especially in healthcare. It’s incredibly hard to earn trust, and incredibly easy to lose. We’ve seen several brands come out recently to prioritize trust and transparency in healthcare – namely Mark Cuban Cost Plus Drugs, and Aledade (both of which are public benefit corporations), and hopefully firms continue to move in this direction.

To this end, Commons Clinic knows trust is at the core of the care delivery relationship and is taking a One Medical-esque approach to working with patients – with the goal of delighting patients along every step of their journey. Nick & team know they never want to sacrifice quality or reputation for growth. The ‘growth at all costs’ ZIRP-era adolescent phase of tech-enabled services are hopefully at an end. Commons Clinic wants to be thoughtful about expansion – thinking about density and customer LTV rather than growing for the sake of growth.

Context and More Thoughts from me

Why is Commons Clinic in a unique spot?

A broad-based movement toward risk in healthcare. I know there are plenty of hospital leaders who dispute this movement within their own operations. “Value-based care will never happen / is a farce” is a common expression heard behind closed doors. While that may be true for select price making systems, reality is that payors are aggregating ambulatory assets, pushing volumes out of hospitals, and are increasingly winning in markets more often than not. And when CMS starts forcing mandatory participation into alternative payment models, we might see some panic set in from systems hopelessly behind.

Health systems are in a more vulnerable, ‘disrupt-able’ spot post-pandemic. As they focus on system-wide transformation and outpatient migration puts market share up for grabs, health systems face multiple headwinds (labor and physician subsidy struggles, payor mix deterioration, network leakage). While holding historical advantages commanding higher rates or boasting superior scale, health systems are structurally disadvantaged against risk 2.0 – new vertical entrants capturing physician specialties and volumes migrating outpatient. Price transparency data is exposing extreme variations in procedures, and consequently we should see some pricing scrutiny around HOPDs.

Physicians want agency, ownership, and wealth. Commons Clinic and other enablement players, concierge care, direct primary care, and emerging models offer untraditional, yet viable pathways out of the compensation productivity grind.

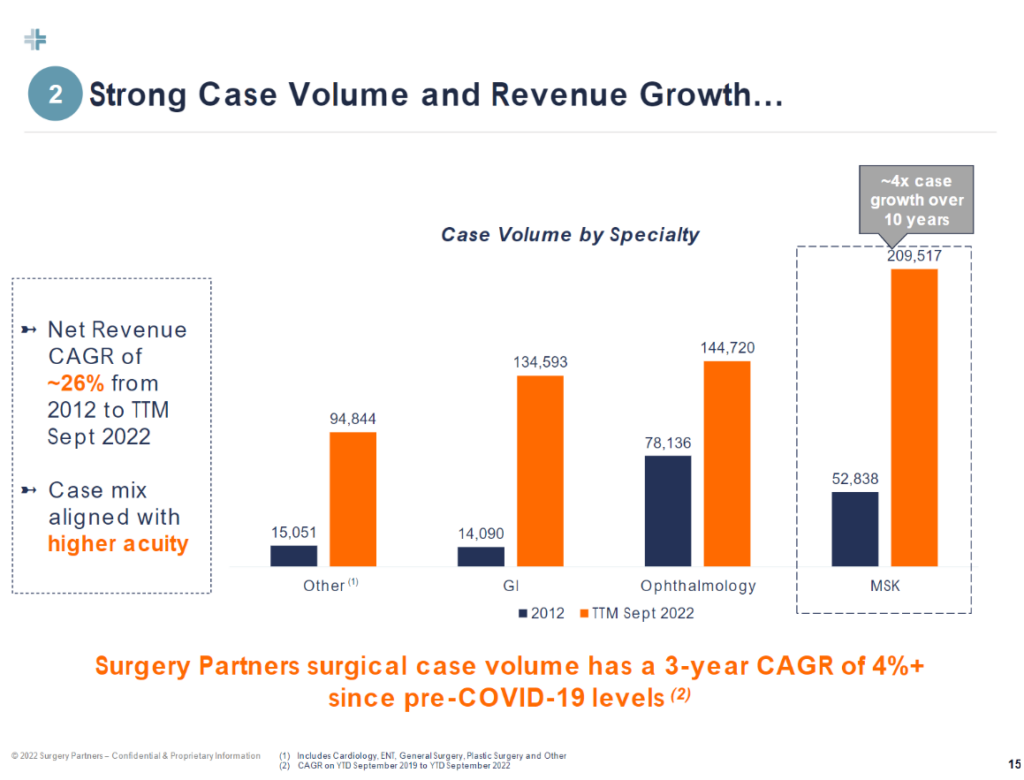

Orthopedic cases are growing and moving into the outpatient setting. Like I wrote in my piece on the rise in utilization, volumes are returning to healthcare in 2024 at an elevated level, and orthopedic procedures are a key area of growth for the foreseeable future. Orthopedic care is one of a few specialties growing like wildfire, moving to the outpatient setting, and orthopedists, for fear of over-generalizing an entire group of specialists, are a staunchly independent bunch.

Ambulatory surgery centers are key to a cohesive value-based care vertical strategy. Many in the ASC space will tell you that ASCs ARE value-based care by default. Owning and operating a key part of vertical healthcare delivery in the ASC makes the Commons Clinic bundled offering much more compelling to payors and employers.

Bottom Line: Firms like Commons Clinic are Threatening Health Systems and Traditional Healthcare Delivery. Adapt or Die.

Obviously there’s a long road ahead for Commons Clinic and any other potential players in this arena. Execution risk lies at every turn along the playbook. But if you’re a health system, players like Commons Clinic are your new competition.

Whether you think competitive threats like Commons Clinic are viable and sustainable or not, they have high conviction, they ARE entering health system terrain with substantial market-moving capital (Commons Clinic has raised $33M+ to-date), are providing an alternative to traditional partnerships with wealth generating ownership opportunities for physicians, and finally, are introducing competition for the sought-after, profitable, high-margin services. Adapt or die.

Further reading + resources:

- https://commonsclinic.com/

- https://dembones.substack.com/p/msk-vbc-the-role-of-condition-specific

- https://www.prnewswire.com/news-releases/commons-clinic-announces-19-5m-series-a-financing-to-unseat-specialty-care-incumbents-with-its-new-model-for-spinal-care-orthopedics-and-pain-management-301951044.html

- https://medcitynews.com/2024/01/musculoskeletal-spine-vbc-healthcare/

Thanks for reading! Subscribe to Hospitalogy, my newsletter breaking down healthcare finance, M&A, and strategy twice weekly. Join 30,000+ executives and investors from leading healthcare organizations by subscribing here!