We’re a month into my new format, and I’ve finally had the chance to finish the revamped newsletter format and cadence. I think I’ve nailed it, but please let me know if you have any feedback for me. Lots of these changes came with you guys in mind!

(For those of you new and old to Hospitalogy, I announced a revamp to my content introducing more exclusive deep dives for my community)

Here’s the new breakdown:

Tuesdays:

- 1-3 biggest healthcare headlines from the week

- Strategy Spotlight (breakdowns of developing trends to keep a pulse on)

- Partnerships Pulse (link roundup of important partnerships & collaborations)

- My favorite healthcare reads

Every other Wednesday:

- Community deep dive (This week’s is a Q1 recap of all major themes from the first quarter including links to research reports, my original analysis, and data books for publicly traded companies like HCA and Privia)

- Upcoming community events (Briefs with Blake, fireside chats, networking, etc.)

- Join the community here.

Thursdays

- Visual-forward breakdown of a key trend, report, or story

- One trending healthcare topic from the week (social discourse)

- Dollars and Deals (Breakdowns of notable finance and M&A happenings)

- Venture spotlight (all things fundraising, venture, and startups)

And of course, the newsletter will continue to have Miscellaneous Maddenings!!

Welcome to Hospitalogy, a newsletter breaking down healthcare finance, M&A, and strategy twice weekly. Join 30,000+ executives and investors from leading healthcare organizations by subscribing here!

Walmart Health’s Shocking Shutdown and the Demise of Retail Health?

“Walmart Health is Closing” today’s press release declared, sending shockwaves through social media channels this morning. Walmart is done with dabbling in healthcare – for good.

After a long journey, the Fortune 1 company is exiting healthcare completely, closing down its 51 Walmart Health Centers and exiting the telehealth business.

- “Through our experience managing Walmart Health centers and Walmart Health Virtual Care, we determined there is not a sustainable business model for us to continue.”

I guess Walmart finally figured out healthcare is hard.

And the economics of primary care are even harder. Just ask a PCP.

Even so, the news is shocking.

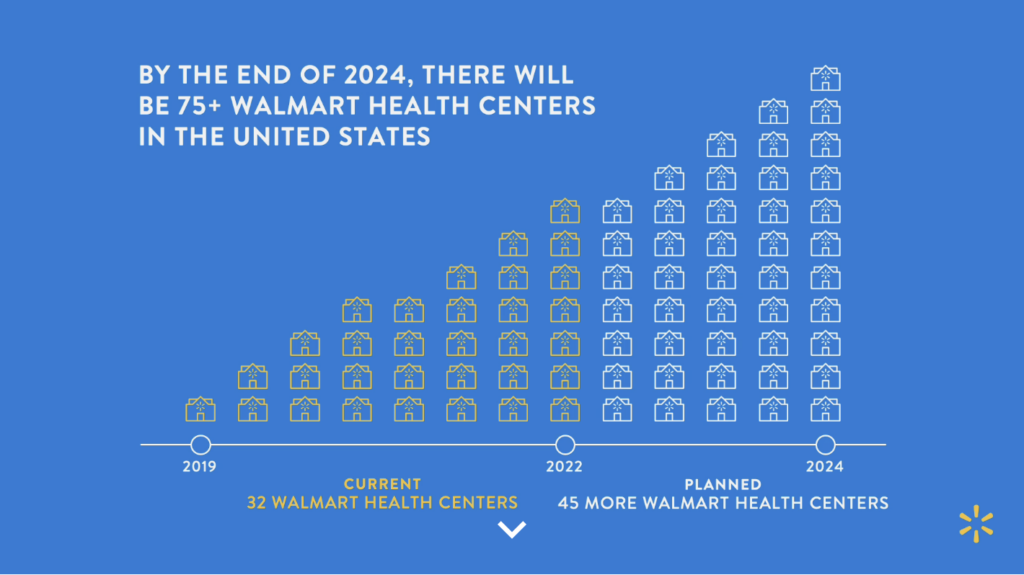

As recently as mid 2023, Walmart Health had a new roster of seasoned executives and announced plans to develop 75+ Health Centers by the end of 2024. It had acquired telehealth platform MeMD. Walmart had identified 28 new sites in multiple markets, characterizing the announcement as “growing in a big way.”

Finally! Walmart has figured out its healthcare strategy. They’re gonna crack the code, deliver care transparently and efficiently, and apply pressure to the status quo. There’s even a big opportunity in rural America given how many Walmarts there are throughout.

Walmart even announced partnerships with traditional healthcare players like Optum and Ambetter Health. In September (7 months ago! That’s like the blink of an eye in healthcare terms). Bloomberg reported Walmart was rumored to be eyeing an acquisition of ChenMed. That’s not even close to resembling a wind-down in Walmart’s healthcare strategy. That’s doubling – no, tripling down on primary care and Medicare Advantage.

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

And now here we are a year later, with a complete exit from healthcare delivery. Like I said. Shocking. Let’s just stick to eyeglasses next time.

Bigger Picture: Cream is Rising to the Top

Retail health players set an ambitious goal over the past several years to enter healthcare, and do so in a big way. So, what has gone wrong for VillageMD and Walmart?

You simply cannot stand up primary care services without also anticipating material downstream financial windfalls. The classic example here is the urgent care → specialty services pipeline within health systems. Standalone primary care – unless you’re an excellent operator – is a nearly impossible game. It’s why you’re seeing physicians increase their exit in the space in favor of concierge medicine or direct primary care.

Clearly, several of the following held true for Walmart:

- Building out health clinics required significant capital outlays and staffing, and foot traffic probably wasn’t there to support a standalone operation. To stand up de-novo centers, you need to find the staff, and it sounds like that was a struggle.

- Similarly to embedded VillageMD clinics within Walgreens, people probably don’t want to receive primary care services within a Walmart. I mean, I sure as hell don’t. (Interestingly, unless I misinterpreted recent comments, CVS seems to be doubling down on this strategy by embedding Oak Street Health clinics within CVS locations. I think that’s odd, but maybe they know something I don’t!) Patients, outside of getting a shot or a low-acuity condition, would much rather go to a setting that provides continuity of service if needed.

- Downstream financial impact to pharmacy or retail sales couldn’t be quantified or Walmart was otherwise unable to justify the cost of standing up new clinics.

Takeaway: Even for the largest company in the U.S. by revenue with significant resources to throw at a problem, you can’t simply enter healthcare and expect the economics to work. I’d expect to see similar struggles upcoming for other companies who, out of fear of missing out, followed suit in the retail health space.

Also – primary care physicians and clinicians are saints and we need to protect them at all costs.

Telehealth and Digital Health 2.0

From a telehealth perspective, this Walmart Health news, combined with Optum’s decision to exit the telehealth business and conduct layoffs en masse, is a natural progression for digital health out of the pandemic induced-ZIRP (zero-interest rate policy/phenomenon) era.

Optum’s telehealth product was apparently terrible, but besides this factor, virtual care delivery has been largely commoditized. It’s now a feature of a tech-enabled service, clinic, or health system. Things like online booking, access for low acuity services, and messaging are increasingly table stakes as healthcare services adopt consumer-centric practices. Standalone telehealth, similarly to standalone primary care, is a race to the bottom.

As a result, in search of sustainable margin and defensibility, telehealth and virtual care delivery platforms are maturing, characterized well by Joe Connolly here into things like continuity of care / coordination. From a recent Zocdoc report, patients are using telehealth solutions as local follow ups with community physicians or individual practices. 50% of all virtual appointments on Zocdoc’s platform take place within 20 miles of the patient. Healthcare is local and hybrid, and having some rigid, inflexible national offering ain’t gonna cut it:

For instance, companies like KeyCare have developed wraparound services for owned health system clinics while integrating deeply into Epic. With money drying up and profitability as a priority, differentiation. SteadyMD, Wheel, and others power telehealth platforms like Amazon’s behind the scenes. But a rigid platform like Teladoc, which refuses to white label or transform its business model, cannot thrive in 2024. Just take a peek at its stock price and recent executive turnover. Teladoc’s story presents a pretty compelling case study within healthcare. The firm had all of the first-mover advantages into telehealth and failed to capitalize.

Along with telehealth, we’re observing the next phase of maturity for digital health across multiple categories – data, AI, value-based care enablement, and more. While harder than ever, it’s an exciting time to see the second inning of digital health firms unveiled.

Further Reading + Resources:

- Walmart’s announcement

- My update on retail health to start 2024

- Optum’s Telehealth Shutdown Is Just the Tip of the Iceberg (nice analysis from

- Farzad Mostashari’s tweetstorm

Strategy Spotlight

Key considerations for decision makers. Notable moves, policies, and strategies.

- US Chamber of Commerce sues to block ban on noncompete clauses. It unfortunately isn’t happening any time soon, yall.

- How the FTC’s noncompete ban could affect Epic.

- Bill would extend hospital-at-home program through 2027.

- The Evolution of Healthcare: Trends to Watch in 2024 | FTI.

- UMich will buy part of former KMart HQ for new medical center.

- Study Reveals AI enhances physician-patient communication.

- Hospitals bulk up cybersecurity teams, budgets.

- Intermountain to exit Kansas with clinic changes (already exited Idaho).

Partnership Pulse

Collaborations and launches to keep a pulse on.

- Maven Clinic expands fertility support for males alongside health coaching program.

- MD Anderson, Rush bring new partnership to Chicago.

- Tufts Medicine and Navvis partner to accelerate value-based care.

- AndHealth partners with PrimaryOne Health to address health inequities by offering in-house specialty care.

- Headspace launches direct-to-consumer mental health services.

Hospitalogy Top Reads

My favorite healthcare essays from the week

The CBO’s report on Medicare ACOs and MSSP.

Tim Fitzpatrick’s excellent expert Q&A on all things in the kidney care space.

ProPublica’s continued look into the denials practices of major health insurers including medical directors with little oversight.

Bain’s Global Healthcare Private Equity Report for 2024.

Thanks for reading! Subscribe to Hospitalogy, a newsletter breaking down healthcare finance, M&A, and strategy twice weekly. Join 30,000+ executives and investors from leading healthcare organizations by subscribing here!