Hospitalogists,

I received some great responses from my newsletter on private equity’ role in healthcare and finding an equilibrium, so I decided to turn it into a third send (all anonymous). Lots of great perspectives below and I enjoyed those of you who took the time to respond!

Interestingly (and somewhat to my dismay), I posted a shorter version of my original essay on Twitter and was met with a visceral reaction from the mob – tribalism on full display, unfortunately.

Simply put, many folks on there seem to be unable to have a thoughtful discussion without triggering an emotional reaction. The scene there highlights how many individuals feel burned by private equity involvement in healthcare and conveys just how far apart we really are on this issue, along with general challenges of discourse on social media.

It’s fine to disagree with me. It’s not fine to call me mentally challenged!

Meanwhile, my DM’s, text messages, and email replies tell quite a different story – agreeing with me, or providing a more nuanced, thoughtful take. Again, I am more than happy to hear out thoughtful dissent.

The simple takeaway here is that what is reflected on echo chambers within social media distorts the reality of what’s actually going on in healthcare. While you can find great people, connections, and a small contingency of folks who want to engage in thoughtful dialogue, you also go up against the mob when you bring up any sort of ‘contrarian’ take the consensus disagrees with.

With that being said, let’s dive into some of the comments from you guys!

Private Equity in Healthcare: Comments from Hospitalogists

Comment 1:

I really appreciate this essay on PE in healthcare. I’m working at an early-stage startup that has been backed by some folks in what I would consider a model citizen PE firm. We’re actually based in their office, so we get to sit and eat lunch together most days. It’s been pretty cool to listen to their approach to investments and the ways they’re looking to deploy capital for growth opportunities with established companies that are doing well and can reach a greater impact (both financially and for care outcomes) with scale.

The “big hammer” approach of just driving PE out of healthcare would probably have devastating consequences. We’ve seen the downside of bad PE actors coming into organizations and doing bad things… but imagine the long-term consequence of good companies not being able to raise capital to grow to scale and therefore be able to support change across the industry. We’re based in Nashville, and we’ve seen dozens of major players go from mid-size to national scale thanks in part to PE participation in their growth phases. If all of that activity suddenly disappeared, you’d see the healthcare industry largely remain stuck in time; it’s hard to imagine, but (what feels like) the glacial pace of change and innovation would slow down even further.

Thanks for the thoughtful piece on this subject, it’s complicated and important.

Comment 2:

Thank you so much for your informative and thoughtful 2 part PE breakdown. I needed to hear the “good” parts of PE, and I needed to be reminded that it is definitely not black and white and not all the fault of PE. It’s easy to just point fingers, and I appreciate your approach to our healthcare system problems. You are right that there needs to be compromise, and it needs to happen soon. Thanks again for your great work.

Comment 3:

Great article and thought provoking.

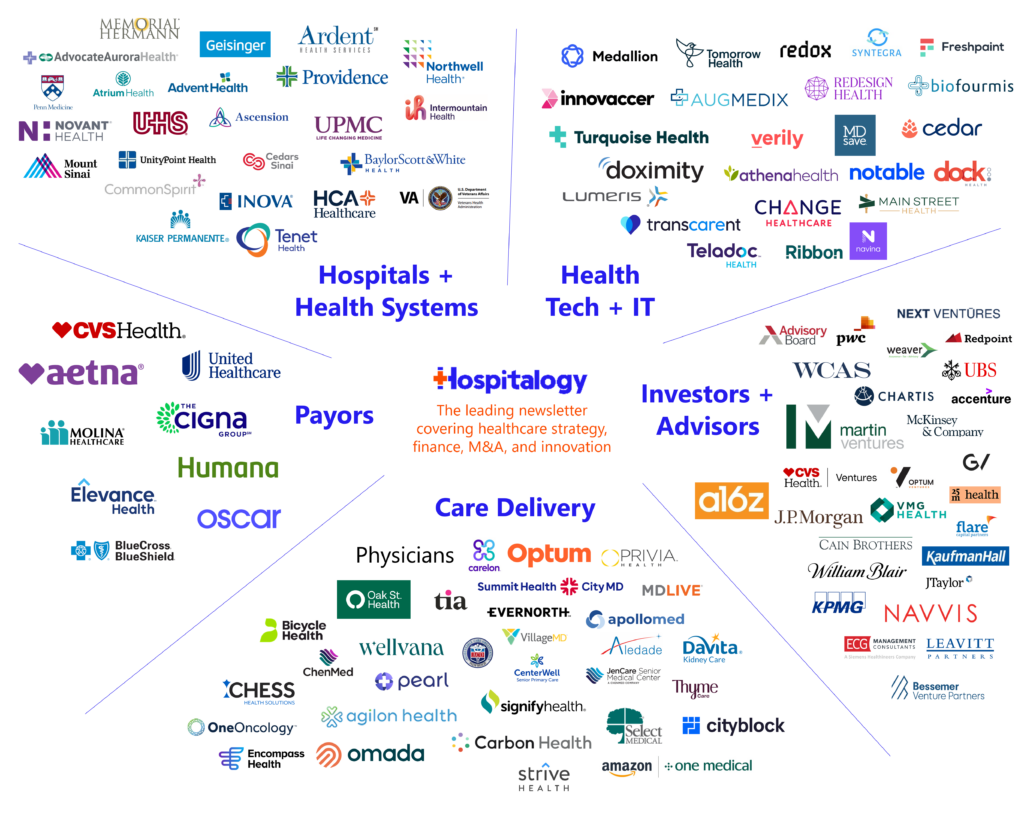

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

One of the things PE suffers from is they get lumped all together the same way other classes get lumped together like all hospital systems. There is a particular time in nursing facilities namely 2006 – 2012 where PE firms got big in nursing homes and pushed quality way down to sometimes atrocious levels. Obviously this was not all PE firms and the evidence suggests it was only marginally worse to be in a PE nursing home than a non PE nursing home on average, but the egregious cases were truly egregious. There is a small but significant cadre of policymakers and influencers who believe in their core that PE firms got away with literal murder in nursing facilities and can’t ever be trusted again.

All the points you make are valid, but sometimes we get judged by the worse actions of our class and the worst action by PE firms in their nursing home era is that they killed people in the name of profit. I don’t know that the reputation of PE will ever completely recover from that.

One of the challenges is that the good guys implore the same legal strategies as the bad guys. To stick with nursing homes, the shield was to own the land, but not the facility, but the rent for the land was a percent of revenue that escalated over time. So a good PE firm who saw the financials and relaxed the rent had the same financial arrangement designed specifically to shield liability as the “bad” PE firm who stuck with the arrangement and drove the facility into the ground. They behaved differently, but on paper they were employing the same tactics.

Comment 4:

I would love to see a dive into payor owned vs PE owned. Because those are the choices individuals are facing now. Which devil do you dance with?

Comment 5:

If you’re implying my PE-backed dentist should NOT be selling me car insurance with my prescription fluoride toothpaste, I am politely telling you to get lost!

Comment 6:

It has always amazed me how many health system leaders acknowledge that their care delivery networks are mission critical but when asked how well they manage patient and information flows across those networks respond with a “uhhh…we don’t”. Unbelievable. In no other industry would you find that. Which brings me to today’s topic of private equity in healthcare.

To say that I am in violent agreement would be a massive understatement. I’ve been present when a health system CFO argued against a readmission reduction program that was “overly” effective because it reduced revenue. Like you I’ve heard surprise out of network billing proudly described as an effective strategy. I’ve seen a PE backed firm cut programs that were clearly benefiting patients because the financial benefits, while significant, fell outside their anticipated holding period. Depressing.

Perhaps the profit motive is antithetical to a high-quality high value healthcare system. Our OECD partners certainly seem to think so and maybe they have a point given their aggregate outcomes and % of GDP spent on healthcare. I would argue we don’t even have a healthcare “system” here in the US. An “industry” yes but a “system” absolutely not. In theory, private enterprise should delivery higher quality care at a lower cost than a government run system but in practice it obviously doesn’t. At a 5% of GDP cost differential over the OECD average (and with poorer aggregate outcomes) that equates to $1.16 trillion of “rent seeking” on a $23.3 trillion economy. Also depressing.

I believe private equity is a symptom of the problem but not the problem itself. The core problem likely lies in the incentives and the fact that healthcare is the ONLY sector of the economy where the pricing mechanism isn’t used to allocate resources. It also the only sector where the consumer of a service a) isn’t the buyer and b) has little to no real agency. Oh, we talk about treating patients like consumers but that’s complete bullshit if the patient in question is faced with a serious diagnosis.

I honestly don’t have a clue what the answers are but I’m pretty sure more regulation isn’t on that list (unless of course we follow the rest of the OECD and go with the public option). If we stick with a profit-motivated approach, then I think we likely have to focus on the incentives. Pop health feels like the right direction but probably needs tweaking.

Comment 7:

In my humble opinion, after seeing the ebb, flow, variety, and scope of private equity in healthcare over the past 20+ years, and the resulting love/hate relationship between providers and investors, it could be said that it is easy to focus on the bad actors and less so on the success and innovation that has come out of a certain amount of ‘capital discipline.’ Both are things that many providers desperately need. All while surviving in the most challenging operating business one could imagine.

So – food for thought going forward – all PE is not created equal. In fact, and closer to my world, PE in healthcare real estate amounts to billions invested every year and the result is usually a very positive outcome for providers. Increased access to services, better environments, happier patients and employees, and capital preserved to spend on service innovation and technology, etc.

Anyhow – your article inspired me to reach out – stay well. If I can help you in any way, please let me know.

Comment 8:

Great topic. There is no doubt that PE is under scrutiny and deservedly so. I love your line in the newsletter about PE, in a vacuum, is not good or bad, holy or evil.. There is nothing inherently wrong with this tool. Just like there is nothing inherently wrong with the model of large contract management groups like envision and TeamHealth. In the case of the CMGs when the focus shifts from providing a service to the doctors to profit that comes at somebody’s expense – typically the physicians and the patients. That is wrong.

As an aside, I imagine you are aware that HCA has agreed to purchase the remaining 9% of Valesco from Envision. I know from personal experience physicians are nothing more than a necessary cost to Valesco. They are clearly on the cost side of the excel spreadsheet. Absolutely, no acknowledgement that all the revenue in the entire Valesco operation is generated by those physicians that cost too much. PE is not the only bad actor.

There was a dude named Paul who wrote a letter to his buddy Timothy about 2,000 years ago and in that letter he made a profound and germane comment “For the love of money is a root of al kinds of evil…” If people just did the right thing, not the most profitable thing this world would be a much better place.

Thanks for tackling this huge issue.

Comment 9:

I’m glad that the FTC is doing something about private equity. We physicians unfortunately have allowed this to go too far. Did you know that only lawyers can own law firms and that noncompetes are not allowed for lawyers either? Why is that not the case for physician practices and physicians? If a PE wants to buy a practice, there needs to be a physician owner or board member at a minimum to protect the integrity of the practice because otherwise decisions are made about healthcare without health care provider input. I’m sick of it honestly. We need to take back health care from corporate abuse and greed. We’ve seen several closures of practices and labor and delivery units in Miami, with another possibly closing as well, leaving many patients without a nearby hospital to go to for their care. I’ve seen the direct consequences of this- I had a patient who had her baby in the ER of the hosptial near her where there used to be an L&D unit as recently as last year; she was transferred to our facility and because of the delays, she bled so much I had to take out her uterus to save her life.

Health care is not a place to make profit. The way to stay afloat is to provide high quality care and PREVENT illness to avoid high costs. Unless you’re in pharmaceuticals or medical devices, no one should expect to make big bucks like in other industries. I think PEs are realizing this now, pulling out, and leaving us all in the dust. Physician owned hospitals need to be made legal again and we need to be at the table in every owned enterprise or else we can expect more of the same destruction.

I’m getting an MBA because I’m tired of others making the business decisions in health care when I’m the one in the front lines seeing it all play out.

Thanks again for bringing up this important topic.

Comment 10:

We work in mental health and private equity has been rapidly growing. Through offering crazy multiples for mental health practices I feel like it’s caused a go for broke mentality in our field when it should be focused on providing the best quality care possible. I have been working with NASW to cut the hold PE has on our field as I feel like it’s harmful for clinicians and clients.

I would love to see an issue pushing back on PE and discussing alternatives to it as I think it’s important for the future of healthcare- especially mental health.

Comment 11:

I feel like a lot of issues with PE owning healthcare assets is around making the debt payments and getting in trouble due to the amount of debt. One crazy idea to solve this? Remove all of the interest deductibility for any healthcare investment. Would still allow investment, but debt will not be used in near the same way. The cost of capital would likely make it such that the investment hold has to be much longer, attracting different types of capital.

If you enjoyed this, consider subscribing to Hospitalogy, my newsletter breaking down the finance, strategy, innovation, and M&A of healthcare. Join 28,000+ healthcare executives and professionals from leading organizations who read Hospitalogy! (Subscribe Here)