Good morning to everyone except the hackers who apparently keep extorting Change Healthcare. Yikes.

Join my upcoming virtual event with two seasoned vets in the value-based specialty landscape (cardiology & kidney care). It’ll be a fun conversation around emerging & ongoing trends in the space!

Welcome to Hospitalogy, my newsletter breaking down healthcare strategy, finance, M&A, and innovation twice weekly. Join 29,000+ executives and investors from leading healthcare organizations by subscribing here!

Healthcare Headlines:

The big stories from the week

MultiPlanned (see what I did there)

The NY Times’ expose on MultiPlan and the behind the scenes value extraction activity happening stemming from out of network billing. There’s a little bit of abuse for nearly everyone across healthcare in this piece – egregious out-of-network billed charges, loopholes in lawsuits, private equity involvement & aggression post-takeover in 2006, payors taking advantage of employers and using MultiPlan as a scapegoat to push payor strategies forward by collecting fees on differences between billed and collected sums. This part stuck me as pretty funny – Envision’s last laugh fueled this NY Times article against health insurers given that many of the unsealed court documents are referenced throughout: “UnitedHealthcare blamed “egregious” charges by out-of-network providers and suggested that criticism of its work with MultiPlan had been stoked by a private-equity-backed medical staffing firm that is suing the insurer.” Also, I guess we never really got rid of balance billing – ‘Legislation that took effect in 2022 now protects patients from certain kinds of surprise bills but does not cover a vast majority of the claims directed to MultiPlan.’

Optum tries to buy Steward Medical Group:

Among financial challenges and pressure mounting, many news outlets reported Steward was trying to sell its physician network subsidiary – a multispecialty group with 1,700 physicians and clinicians in 11 states – to Optum.

My take:

- Optum already owns Atrius and holds a significant presence in the state, so this deal is getting some intense pushback from regulators.

- If not Optum, then who? Was this a competitive bid process? If this is a desirable asset shouldn’t we have seen some interest from other healthcare players in the market?

- Many mergers are starting to get to a ‘last resort’ stage (see Optum & the Corvallis Clinic) and on the hospital side as well, many deals are done just from the standpoint of survival. If the state doesn’t approve the deal, where does that leave these physicians and clinicians? If these groups can’t survive without Optum coming in to save the day,

- CareMax struck a deal in 2022 to manage the population health for all of Steward’s physicians. Where does this deal leave them, and what are the implications of Steward going under on CareMax given their close relationship, and Steward’s option to buy 30%+ of CareMax’s equity? Seems like a tough spot to be in if a huge vehicle for future growth organizationally is now owned by…Optum

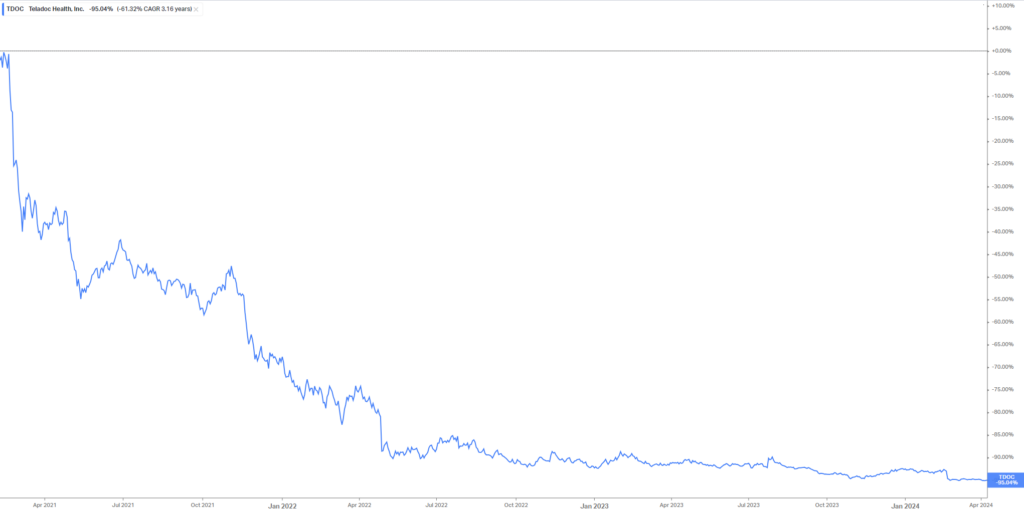

Teladoc CEO out:

After a long, impressive 15-year run, a pandemic-fueled stock rally nobody will soon forget, an $18B+ acquisition of Livongo, and finally a refusal to bend the knee to the reality of the commoditization of telehealth (leading to a 95%+ decline in stock value from pandemic highs), Jason Gorevic is stepping down from the helm of Teladoc. It is crazy to see a company that fueled so much innovation and change in healthcare down 34%+ from its IPO. Assuming he stays in the game, I’ll be looking forward to seeing what Jason cooks up next.

Kaiser-THV forms PACE startup:

Together with Town Hall Ventures, Kaiser Permanente formed a new PACE startup called Habitat Health. PACE – short for Program of All-Inclusive Care for the Elderly – is an interesting post-acute care program providing fully integrated services to seniors with low incomes and most of the time, multiple chronic conditions. It also requires intense upfront capital investments to stand up a program, so there’s a natural barrier to entry there. There’s only one publicly traded PACE provider – InnovAge (recently held an investor day you can view here) and it seems as if the program takes a while to ramp and find financial success while helping seniors in a proven model. That being said, Kaiser is a good partner to partner on a venture with, and I’m looking forward to hearing more from Habitat Health.

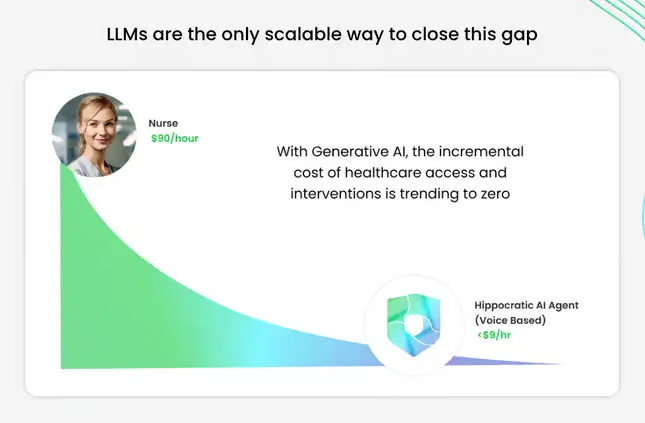

Hippocratic AI’s $9 Nurse?

Hippocratic AI is developing a staffing marketplace where payors, health systems, and other stakeholders can “hire” generative AI agents to complete low-risk, non-diagnostic, and patient-facing tasks.

The marketing language kind of sets itself up to be a nurse ‘replacement’ when in reality it sounds like they’re building a supercharged AI nurse extension offering for folks who want to try out the AI healthcare agent as someone who can auto-follow up with patients on easy stuff without having a clinician in the loop. That way, nurses can focus on more important things.

Hippocratic AI’s thesis is clear: LLMs will solve the labor and productivity crisis facing American healthcare. Balancing productivity with trust will be key.

- Hippocratic claims its AI nurses outperform human nurses regarding bedside manner, education, and narrowly miss on satisfaction, according to a survey.

- The company’s technology is being tested by over 40 healthcare providers around the country.

What else is trending?

Surescripts Sale: While rumors of a Surescripts sale have been floating for a while, talks seem to have picked up steam. Business Insider (paywall) reported the e-prescribing company is exploring a sale and hired a banker to facilitate those proceedings.

CMS proposed rates for 2025:

MA Broker Comp: CMS final rules on broker compensation (stricter rules and fixed fees – $100 – around financial conflicts of interest for brokers) and an added emphasis on health equity could create some major industry shakeup in brokerage land

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

Commure’s product announcement around launching new AI products, including an ambient scribe.

Walmart’s decision to slightly push back the timeline on its Walmart Health clinic openings. This year it’s opening 22 (down from a planned 30), 18 of which are in Texas and the remaining 4 in Kansas City.

VC+Health Systems: Aegis Ventures’ partnership announcement with 9 health systems, similar to recent announcements from a16z and General Catalyst, to form the Digital Consortium

FTC Doubles Down: The FTC does not want the recent Novant-CHS deal to go through, stating the deal would ‘irreversibly’ harm competition.

Sutter-Abridge: Abridge notched another health system partnership under its belt with California-based Sutter Health.

Q1 2024 funding blues: Rock Health noted a muted funding environment for digital health in the first quarter of 2024: “Q1 2024 was the lowest first quarter by sector funding since 2019, noteworthy given that Q1 was the top-funded quarter of the entire year in 2022 and 2023.” Still, while funding amounts are low, pace of deals is strong.

Hospitalogy Top Reads

My favorite healthcare essays from the week

Don’t forget to register for my upcoming virtual event!

Get caught up quick on some of my most recent sends & announcements:

- Revamping my community and what’s next for Hospitalogy

- Private equity’s role in healthcare: comments from Hospitalogists and my original essay

- Analyzing the $19.2B proposed merger between Northwell Health and Nuvance

- The hospital strikes back: why Kaiser Permanente formed Risant Health

If you enjoyed this post, subscribe to Hospitalogy, my newsletter breaking down the finance, strategy, innovation, and M&A of healthcare. Join 29,000+ healthcare executives and professionals from leading organizations who read Hospitalogy! (Subscribe Here)